Marketing Spotlight: Mapping Katana’s Marketing and Sales Tactics

Article summary

Share

TL;DR: Conclusions and Key Takeaways

🎀 This section gives you the main insights without all the details. It’s the stuff you need to remember, whether you’re reading this now or in 6 months. We made this for people who want to get the core message fast.

Katana is a cloud inventory platform targeting businesses stuck between spreadsheets and ERPs (enterprise resource planning). They raised $16.4 million Series B in October 2025 and run an aggressive GTM motion focused on LinkedIn (2.9k ads) and Google (200+ YouTube ads). Their strategy is demo-driven with transparent pricing up to 50k monthly orders, then gated for enterprise deals. They abandoned Facebook after low engagement and put zero budget into Meta.

Katana Academy is their retention engine, reducing churn through education. The Partner Program scales distribution by turning accountants and consultants into referral sources. They repurpose customer training videos as ads (5 million views on some). Use cases by industry speed up evaluation and capture high-intent SEO traffic.

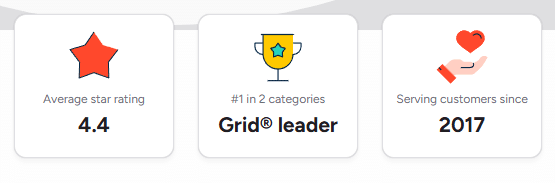

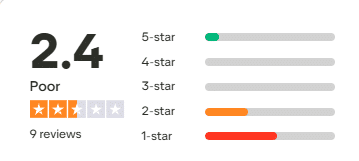

Review sentiment is split. G2 shows 4.4/5, but Trustpilot is 2.4/5. Main complaint is pricing changes pushing out long-time SMB (small and medium-sized) customers, which contradicts their marketing positioning. Leadership presence is minimal.

Key Takeaways

- Transparent pricing with a calculator qualifies leads before sales talks to them.

- Partner programs scale revenue without scaling headcount.

- Education platforms (like Katana Academy) reduce churn and shorten sales cycles.

- Repurposing content across the funnel multiplies ROI.

- Test channels ruthlessly and kill the ones that don’t convert.

- Lead with outcomes in case studies, not buried at the end.

- Industry-specific use cases improve SEO and speed up evaluation.

- An integration ecosystem creates switching costs and retention.

- Free trials (full access, real limits) prove value better than feature restrictions.

📝 A quick note before you start reading: The data and analysis in this article are valid as of the time we wrote it. We don’t know when you’ll be reading this, maybe next week, maybe six months from now, and things might have changed since we looked at this company’s marketing and sales approach. Still, the insights and lessons here stay useful, even if the numbers or tactics have evolved a bit.

Every business today manages inventory across multiple systems. From spreadsheets tracking stock levels to separate tools for orders, manufacturing, purchasing, and reporting, critical data lives in too many places. This creates blind spots, stockouts, overstock, and way too much manual work. So why piece together a dozen disconnected tools when you could use one platform designed to give you complete visibility?

At Milk and Cookies Studio, we believe in keeping things simple, efficient, and effective. We’re always on the lookout for better solutions that work for our clients, all while staying within budget. As a solution, Katana promises a cloud inventory management system that replaces error-prone spreadsheets and overkill ERPs, built specifically for growing manufacturers and product businesses.

Curious how they’re competing against established players while building a Partner Program that turns accountants into their sales force? Let’s unpack together Katana’s marketing and sales strategy.

Understanding Katana

Katana is a cloud inventory platform, offering built-in inventory, production, and reporting features that give you an end-to-end inventory management solution for modern businesses.

Founded in 2017 by Kristjan Vilosius, Priit Kaasik, and Hannes Kert, they have headquarters in Tallinn, Harju, Estonia, with staff across North America, Europe, and New Zealand.

Their latest funding round was in October 2025, where they raised $16.4 million in Series B, led by Cogito Capital Partners. Series B funding means they’re past product-market fit and scaling distribution. That $16.4 million is going into customer acquisition, which explains the aggressive LinkedIn ad spend (2.9k ads running). When you see fresh funding, you know the GTM machine is about to accelerate.

Katana’s Brand Promise Analysis

In the site’s hero section, we see the first brand promise: “Simplify your inventory and scale your business.” With Katana, you can ensure on-time deliveries, accurate stock levels, and a resilient supply chain.

“Simplify” is the operative word here. They’re not competing on features or sophistication. They’re competing on ease of use. This is classic disruptor positioning. You go after the mid-market that can’t afford enterprise solutions and doesn’t want the complexity anyway.

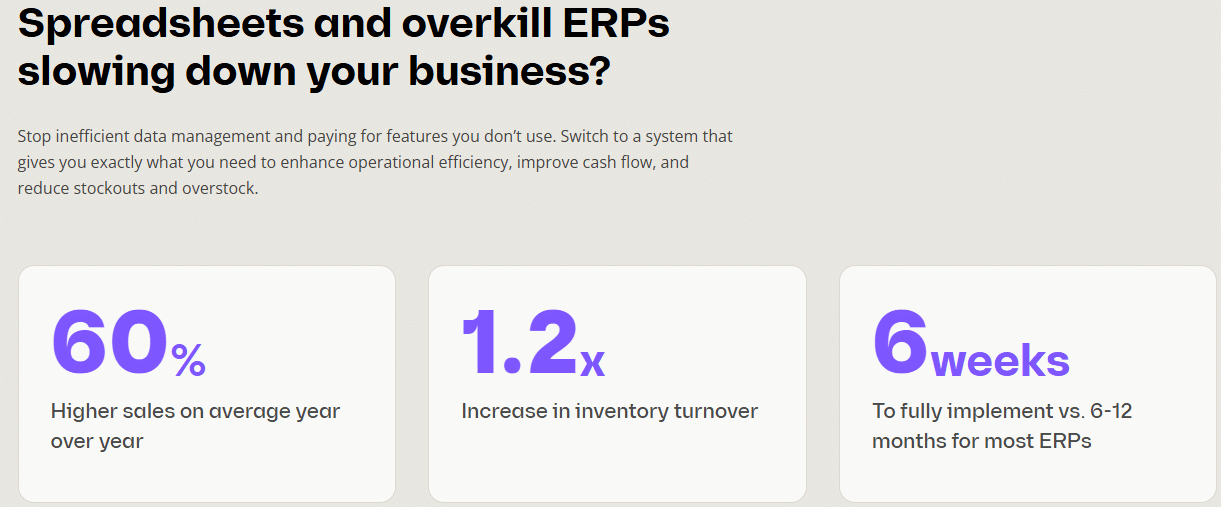

If spreadsheets and overkill ERPs are slowing down your business, consider Katana. Stop inefficient data management and paying for features you don’t use. Switch to a system that gives you exactly what you need to enhance operational efficiency, improve cash flow, and reduce stockouts and overstock.

They promise 60% higher sales on average year over year, 1.2x increase in inventory turnover, and 6 weeks to fully implement vs 6-12 months for most ERPs. Leading with specific numbers is smart conversion copywriting. They’re concrete outcomes that CFOs and operations managers can pitch to their bosses. The comparison to 6-12 month ERP implementations is strategic. Time-to-value is a major consideration in software buying decisions, especially for growing businesses that need solutions now, not next year.

You can integrate your tools and streamline your workflows. For ecommerce you can connect with Shopify, WooCommerce, BigCommerce, and Amazon. For CRM, connect with HubSpot, Prospect CRM, Salesforce, Pipedrive, and many others.

Integration capability is a moat, not just a feature. When prospects see their existing stack listed, buying risk drops. They’re adding one piece that plays nicely with everything else. This is critical for GTM because it shortens sales cycles. No “Will this work with our current setup?” objections.

For new people, guided onboarding is offered. For customers, you have Katana Academy, where you can learn, discover solutions, and find guidance at your own pace. Onboarding is a revenue retention strategy. The easier you make it for customers to get value fast, the lower your churn. Katana Academy is doing double duty here: it’s a sales tool (prospects can educate themselves during evaluation) and a retention tool (customers find answers without contacting support).

The last promise is that Katana will help you get visibility over your sales and stock.

Katana’s Service and Product Breakdown

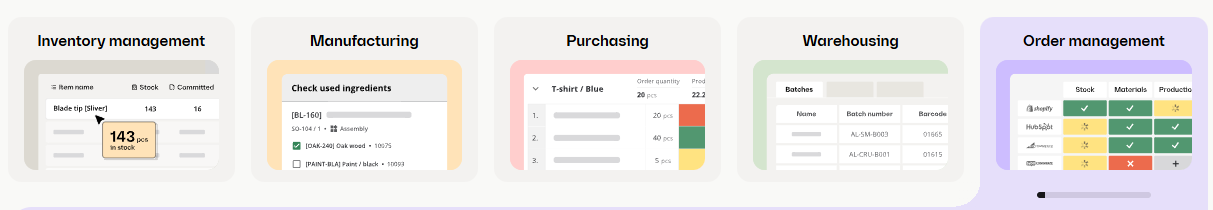

Katana’s current features are: inventory management, manufacturing, purchasing, warehousing, and order management.

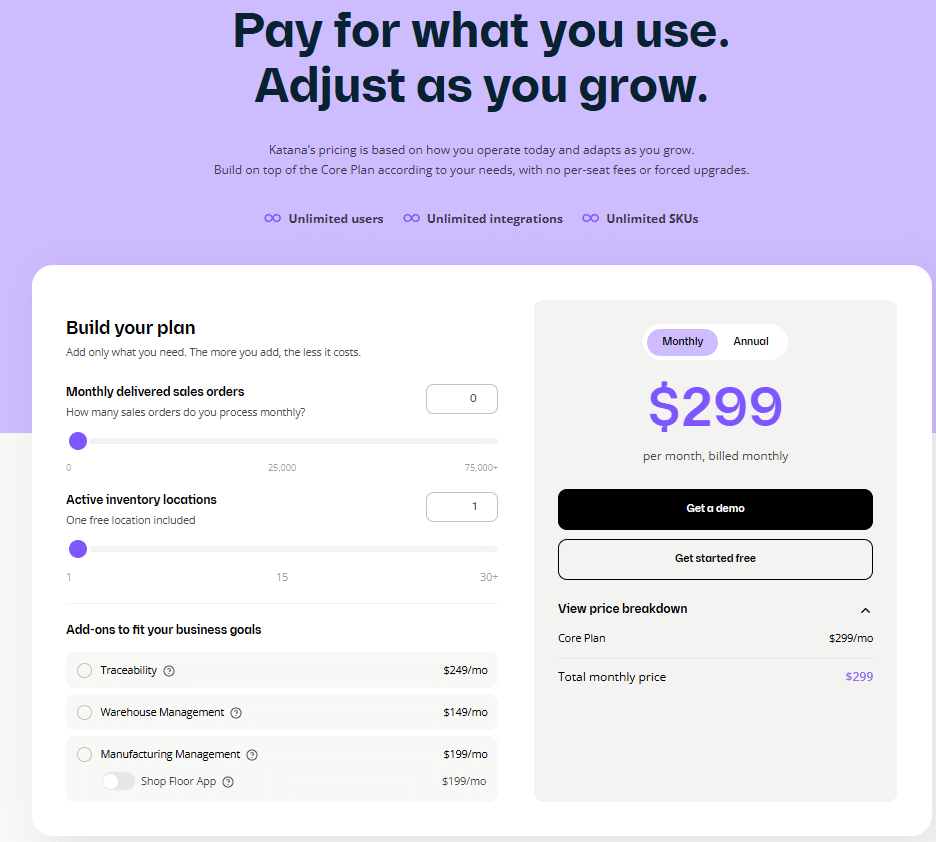

Their pricing page offers a calculator to see exactly how much it will cost for your business. The starting price is $299 per month. Just enough to make you think twice, not enough to require a board meeting.

💡 Steal This: If your product has usage-based pricing, build a calculator. If it’s seat-based, show the tiers clearly. Gate custom pricing behind “enterprise-scale” thresholds, but make standard pricing visible. You’ll waste less time on unqualified leads and close qualified ones faster.

Transparent pricing is a conversion accelerator. When people can calculate their own costs without talking to sales, you’re qualifying leads earlier in the funnel. This reduces wasted demo time for both prospects and sales reps. It also builds trust. Hidden pricing screams upselling, while visible pricing says respect for your time and budget. Because, let’s be honest, nobody wakes up excited to play pricing poker with a sales rep.

You can also choose one of the following add-ons:

- traceability, for $249 / mo

- warehouse management, for $149 / mo

- manufacturing management, for $199 / mo

- Shop Floor App, for $199 / mo

More sales per month include sales order taxes and an additional fee for active inventory locations. The add-on strategy is an expansion of revenue built into the product. Customers start at $299/month base, then add modules as they grow. This is how you increase LTV (lifetime value) without churning customers to more expensive competitors. You grow with them. Each add-on represents a new use case or pain point that becomes relevant at different business stages.

For over 50k monthly delivered sales orders, you will need to get a demo, with no pricing simulation available. High-volume businesses need custom configurations and represent much larger contracts. By gating this behind sales conversations, Katana can qualify enterprise deals properly and price based on actual usage, not self-reported estimates.

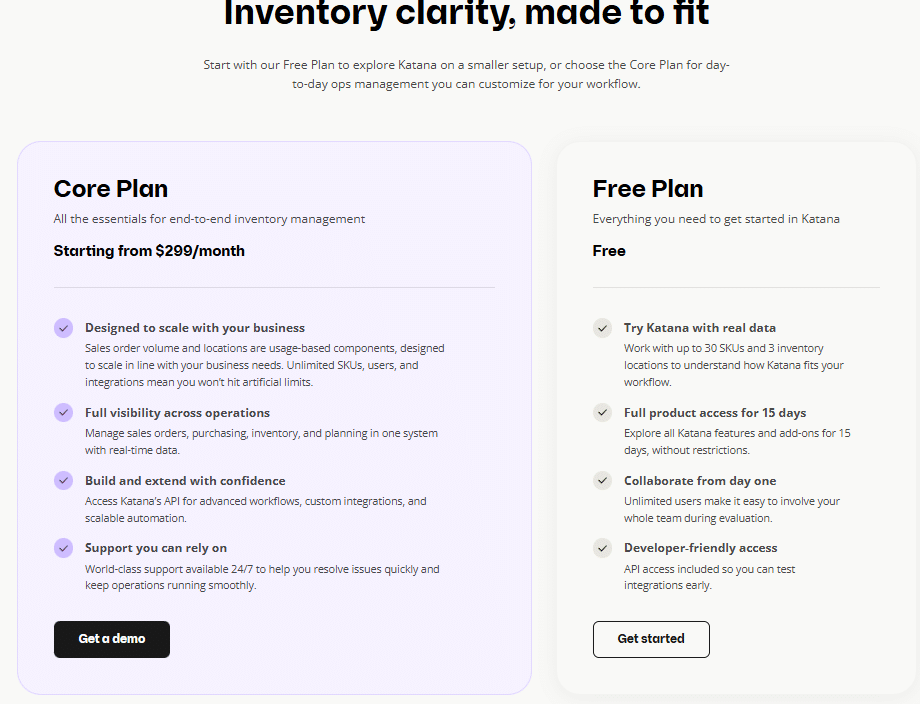

You can start for free, having full product access for 15 days. You can work up to 30 SKUs (stock keeping unit) and 3 inventory locations. This free trial is generous enough to create real aha moments. Most trials are so limited that you can’t actually test the product with your real workflows. Katana gives you API access, which means technical buyers can validate integrations before committing budget. That’s removing a major objection before it becomes one. The 15-day window creates urgency without feeling rushed.

Katana’s Differentiators and Unique Assets

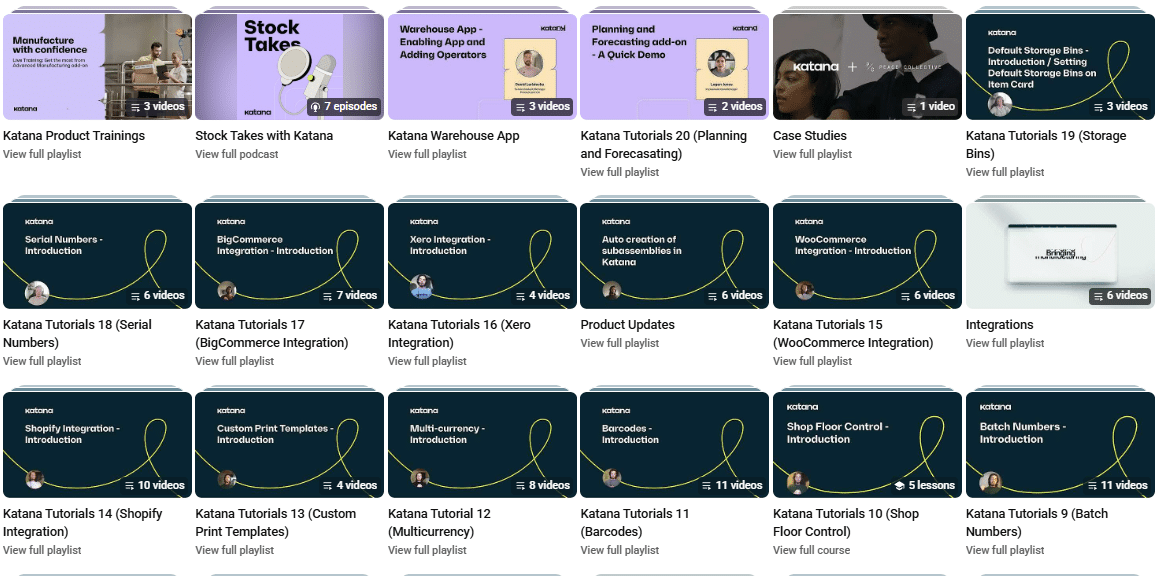

To keep customers close and people who are in the free trial area closer, Katana Academy enters the scene. The Academy is divided into 4 big categories: Getting started, Knowledge Base, Video Library, and Interactive Demos.

Katana Academy is doing something most SaaS companies get wrong. They’re treating education as a growth lever, not just a support cost. When prospects can self-educate during evaluation, you’re shortening sales cycles. When customers can solve problems themselves, you’re reducing support tickets and churn. This is why product-led growth companies invest heavily in education infrastructure.

💡 Steal This: Build a structured learning path for your product. Create content for every stage: onboarding (quick wins), intermediate (power features), advanced (optimization). Make it searchable, video-heavy, and industry-specific. Then measure which content correlates with retention and expansion.

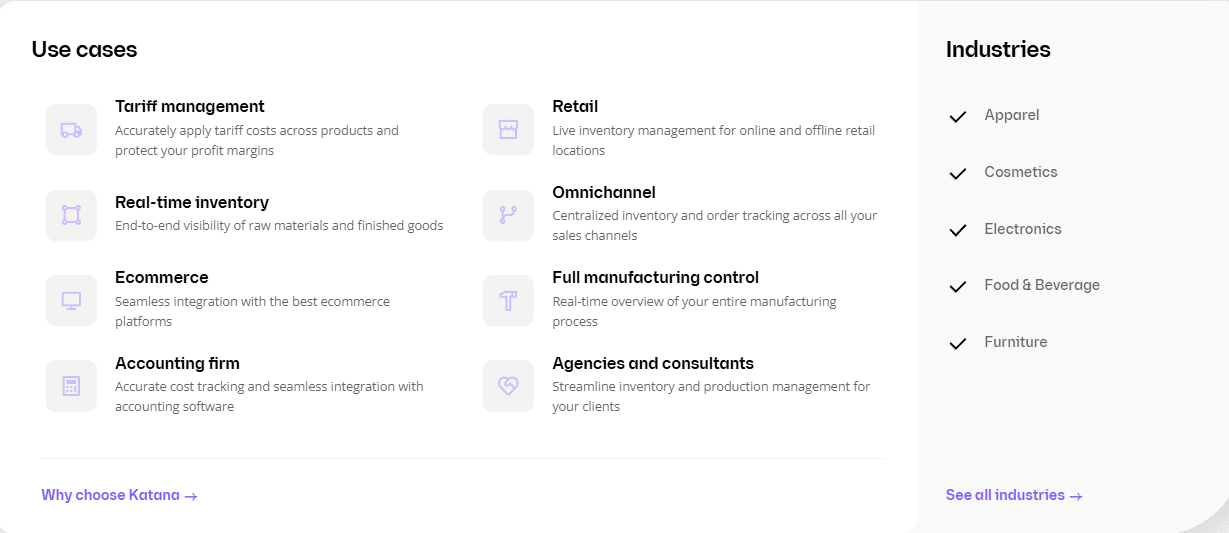

You can also access Use Cases for Tariff management, Real-time inventory, ecommerce, accounting firm, retail, omnichannel, full manufacturing control, agencies, and consultants. You can also search by industry, like cosmetics, apparel and footwear, electronics, manufacturing, software, and many more.

Use cases organized by role and industry are conversion gold. When a cosmetics manufacturer lands on the site, they don’t want to read generic inventory management content. They want to see how Katana solves their specific problems. This is advanced market segmentation that makes marketing more relevant and sales conversations more productive.

In the Getting started section, you will find some useful introduction articles. They are short, with an easy-to-follow table of contents, embedded videos, and screenshots. On the Knowledge Base, you can find more articles on topics like: Items, Sales, Manufacturing, Purchasing and Outsourcing, Stock, and others.

The Video Library sends you directly to their YouTube channel, where you can find courses and podcasts that could help you find your answer. The Interactive demos are a collection of videos of typical processes a business might follow when getting onboarded with Katana. Here you have:

- Katana Overview

- Inventory management

- Sales order management

- Inventory planning and forecasting

- Advanced manufacturing

- Warehouse management

Interactive demos let prospects experience the product without sales involvement. This is critical for product-led growth. Someone in evaluation can walk through actual workflows at 2 am on a Sunday. They’re not waiting for a Tuesday demo slot. The faster prospects can validate fit, the faster they convert.

You can become a Katana’s verified partner and earn commissions. You will help clients streamline operations with an inventory management platform that integrates all their tools. As a verified partner, you’ll unlock exclusive benefits, including revenue-sharing opportunities, priority support, and a direct say in Katana’s product development.

This solution is for accounting firms, consultants, and ecommerce agencies. Just enter your contact info in their form and book a demo.

💡 Steal This: Identify who already recommends solutions to your ICP (consultants, agencies, service providers). Build a formal program with commission structure, certification, co-marketing support, and product influence. Give them everything they need to sell you: demo environments, case studies, competitive battlecards.

The partner program is a distribution channel expansion. Instead of hiring 50 more sales reps, Katana is turning accountants and consultants into its sales force. These partners have existing relationships with Katana’s ICP (ideal customer profile). When your accountant recommends a software, you listen. That’s trusted referral selling, which converts at much higher rates than cold outreach.

You can also become an Integration Partner. Partners get priority customer support and a front-row seat at product roadmap discussions. As ambassadors for Katana, your feedback plays a major role in helping shape Katana into a product your clients will love. All partners get access to a demo account and the supporting materials and consultation they need to pitch Katana as the end-to-end cloud inventory solution clients need.

Integration partners expand Katana’s ecosystem while deepening product stickiness. Every new integration is a new market entry point. A Shopify app store listing reaches thousands of merchants that Katana couldn’t reach through ads alone. Plus, the more integrations a customer uses, the harder it is to switch competitors. That’s retention built into the product roadmap.

Katana offers a Partner Directory, where you can contact different partners, and a Developer Portal, where you can build your own workflows and apps with the Katana API. This shows its platform maturity. When customers can extend Katana themselves or hire partners to customize it, you’re creating switching costs. The investment in custom workflows and integrations makes leaving expensive.

Partner-sourced opportunities have the highest win rates across all GTM motions, with top performers being 843% more likely to overcome objections with partner support. Revenue attribution to partners has grown substantially, with 26-28% of revenue now coming through partners in 2025. This explains why Katana is investing heavily in its Partner Program. Mature partnership programs generate 28% of revenue on average, and the trend is accelerating.

Katana’s Leadership Presence Analysis

Founder-led growth and executive visibility build brand trust and thought leadership. In B2B especially, buyers research leadership before making purchase decisions. A visible, credible executive team can shorten sales cycles and strengthen brand positioning.

Kristjan Vilosius, CEO and co-founder

Katana’s CEO has 3.5k followers on LinkedIn. He mostly reposts from Katana’s LinkedIn profile, with no text. In the last 3 months, he reposted 3 times and posted 1 time. See below his only original post, about a Forbes Technology Council article written by him.

The CEO is relatively quiet on social, which can be a missed opportunity for thought leadership. When founders write for Forbes or other major publications, that content should be leveraged heavily across all channels. One Forbes article can become 10 LinkedIn posts, 5 newsletter segments, and multiple sales enablement pieces. The fact that he only posted once about it suggests they’re not maximizing content ROI from executive thought leadership.

Priit Kaasik, former CTO and co-founder

On LinkedIn, the co-founder and former CTO of Katana has 2.5k followers. Recently, he started to repost more and post original content less. If he or Katana is mentioned, he will repost it. But the original posts are not talking about Katana. They are industry insights and thoughts. As expected, he talks a lot about AI and technology. He stepped down as CTO to found a new company.

Katana’s COO & CMO has 1.9k followers on LinkedIn. In May 2024, she stepped into the role of COO of the company, too. She posts once per week about upcoming webinars, events, and industry insights, through videos or text accompanied by a picture.

Video content from executives performs better than text posts because it builds a personal connection. The fact that she transitioned from CMO to COO shows Katana is maturing from marketing-led growth to operations-led scaling. This is typical for Series B companies. You’ve proven the model, now you need to operationalize it. She still promotes webinars and events, and that suggests that marketing and operations are tightly integrated.

Katana’s co-CEO has 3.8k followers on LinkedIn. He posts or reposts once per week. Almost every single repost is from the company page or news about Katana. Just like Riikka, he announces webinars and Katana Updates.

He’s not trying to be a LinkedIn influencer, but he’s maintaining visibility. Every time he shares a webinar or article, his 3.8k followers see it. That’s free distribution. This is the minimum viable executive social strategy: show up consistently, amplify company content, occasionally share original insights.

The CCO and co-founder, Hannes Kert, has no recent post, although he has 1.2k followers. CCOs could be sharing customer success stories, product feedback, and retention insights. Their silence suggests either that they’re not customer-facing anymore or that Katana isn’t leveraging their executives strategically for brand building and thought leadership.

Katana’s Social Media Strategy

Social media reveals where your ICP actually spends time and what content resonates with them. Channel selection, posting frequency, and engagement rates tell you if marketing efforts match audience behavior. Poor social performance often means misaligned channel strategy, not bad content.

Katana has 7k followers on LinkedIn. They post either twice per week or 5x per week and use single images, carousels, and videos. Their content pillars are: webinars, blog posts, company culture, and events.

They will almost always include a link in the description, and they are heavy hashtags users. Some of their most used hashtags are: #InventoryManagement, #KatanaCloudInventory, #ProductSMBs, and recently, #2026Trends. Their engagement rate is modest, with posts gaining around 30 reactions, a few comments, and reposts.

LinkedIn is their primary social channel, which makes sense for B2B SaaS targeting operations managers and business owners. The inconsistent posting frequency (2x vs 5x per week) suggests they don’t have a solid content calendar or they’re reacting to campaigns rather than maintaining a consistent presence.

Heavy hashtag use is smart for discoverability, especially industry-specific ones like #InventoryManagement. The modest engagement (30 reactions) with 7k followers is about 0.4% engagement rate, which is low but typical for B2B accounts that aren’t doing heavy community engagement.

The real value of LinkedIn for Katana is retargeting. People who engage with posts can be retargeted with ads. Those 30 people who like each post are warm leads. Plus, employees and partners sharing company posts extend reach into their networks. LinkedIn is working as a brand awareness and credibility layer, not a direct conversion channel.

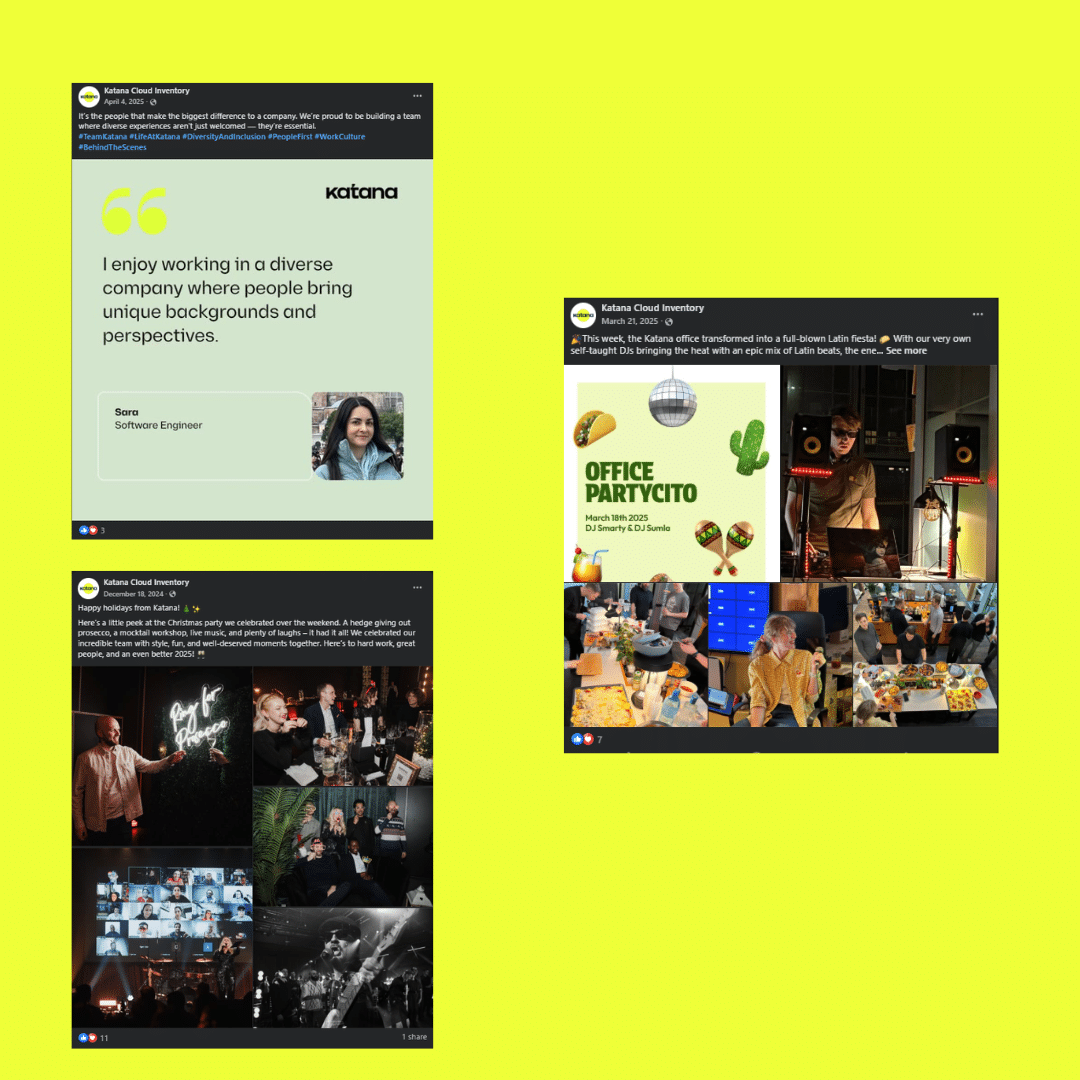

On Facebook, Katana has 3.8k followers. The last post is from April 2025. Here, they were using images mostly. As for their content pillars, they posted a lot about company culture, with snippets from their teambuildings, office parties, and events. Engagement rate was low, with up to 11 reactions and no comments.

Abandoning Facebook entirely is a strategic decision. They tested the channel, saw it wasn’t delivering results, and redirected resources. This is smart GTM. Don’t keep posting where your ICP isn’t engaging. The company culture content they were posting suggests they thought Facebook was for employer branding, but even that didn’t work. Better to double down on LinkedIn where engagement actually happens.

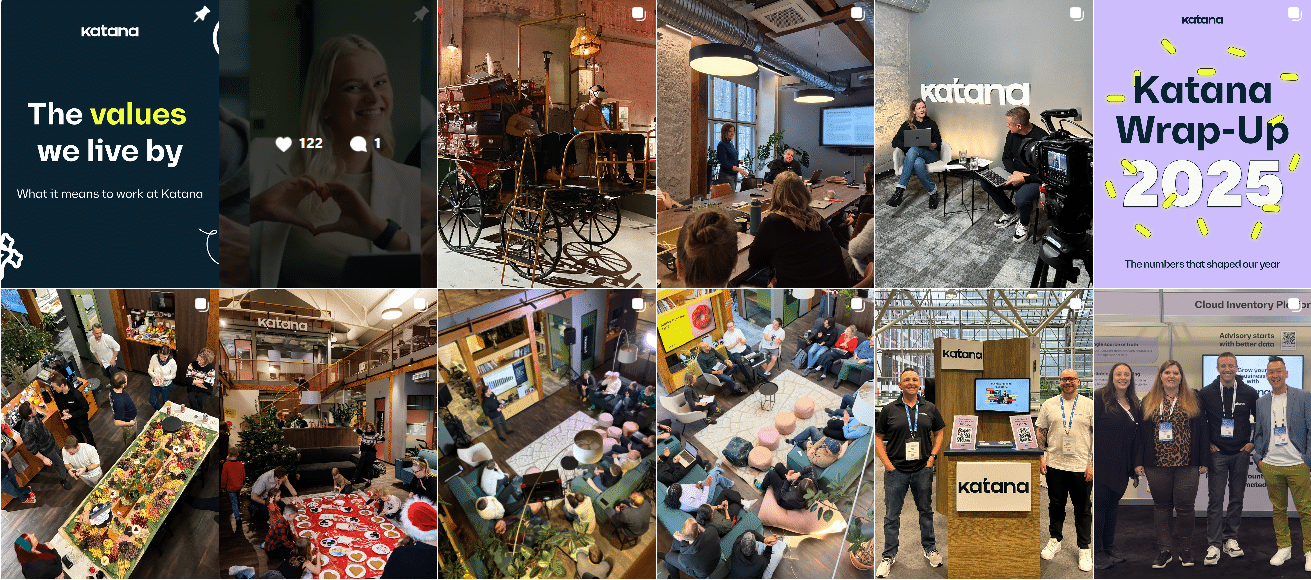

On Instagram, Katana has 1.7k followers. In the bio, you will find a link to their podcasts. They only have 2 highlights: Events and Life at Katana. Company culture is the main content pillar here, just like on Facebook. They are not very active, posting maybe once per week.

They have 2 pinned posts: The Values we live by, a carousel about what it means to work at Katana, and a video of their CEO showing what life at Katana is like. Their usual posts have no more than 30 likes, with almost no comments.

Instagram is serving as employer branding, not customer acquisition. The bio link goes to podcasts, not product pages. This channel is used for recruitment marketing. When you’re hiring in competitive tech markets, showing company culture helps attract talent. The low engagement doesn’t matter if they’re getting quality job applications.

The strategic question is whether this is the right use of resources. If Instagram isn’t converting to customers or recruits, why maintain it? The answer is probably optionality. Social channels take time to build. Abandoning Instagram now means starting from zero if they need it later. Minimum viable presence keeps the door open.

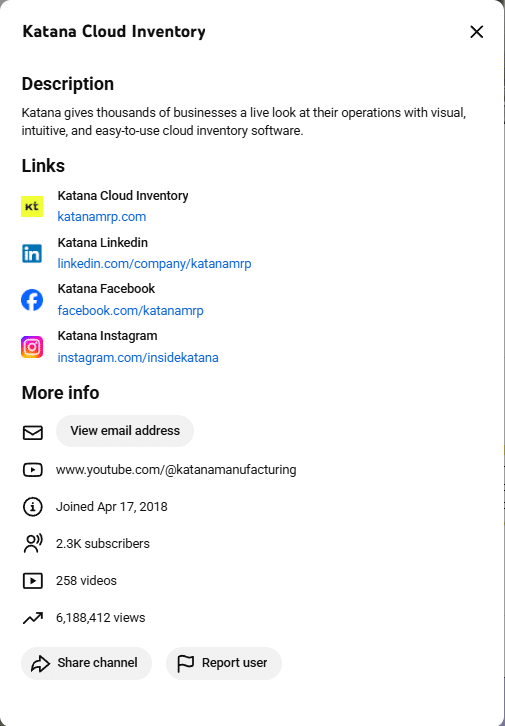

On YouTube, Katana has 2.3 subscribers, 6 million views, and 258 videos posted.

They post long-form videos about product training, webinars, and product updates. You can also find their podcast Stock Takes with Katana, a 7 episodes-playlist. On the Courses tab, you will find:

- Katana Tutorials 10 (Shop Floor Control), with 5 lessons

- Katana Tutorials 2 (Items, Materials, Products), with 10 lessons

- Katana Tutorials 1 (Settings Screen and other basics), with 17 lessons

The other Katana Tutorials can be found in the Playlists tab. They currently aren’t posting any Shorts.

YouTube is their educational infrastructure, not their entertainment channel. With 2.3k subscribers but 6 million views, there’s a huge discrepancy. Most views are coming from non-subscribers, likely through ads or search. The structured course format shows they’re thinking about learning paths, not viral content. This is where prospects go to evaluate the product, and customers go to learn about the features.

They have a few hundred views on their videos, with some of them having only 40 views. Most of their videos have no comments or likes. Low organic views on most videos confirm YouTube isn’t a discovery channel for Katana. It’s a resource library. The high view counts on specific videos were from paid promotion. This is the right approach. Create comprehensive training content once, then amplify the best pieces through ads. The rest sits there for search and reference.

Shorts are for top-of-the-funnel awareness. Katana’s GTM strategy is clearly mid-to-bottom funnel-focused. They’re trying to convert people already searching for inventory management solutions. Long-form tutorials serve that buyer journey better than 60-second clips.

Although Katana has 4.4k followers on X, the last post is from February 2023. They posted about webinars, events, and product updates. The engagement was really low, with only a few likes, reposts, or comments. They probably decided to stop investing in this channel, since there was no traction.

Katana’s Top-Performing Content

Top-performing content reveals what actually resonates with your audience, not what you think should resonate. These insights inform content strategy, ad creative, and messaging across all channels. If partnership announcements outperform product features, that tells you something about what your audience values.

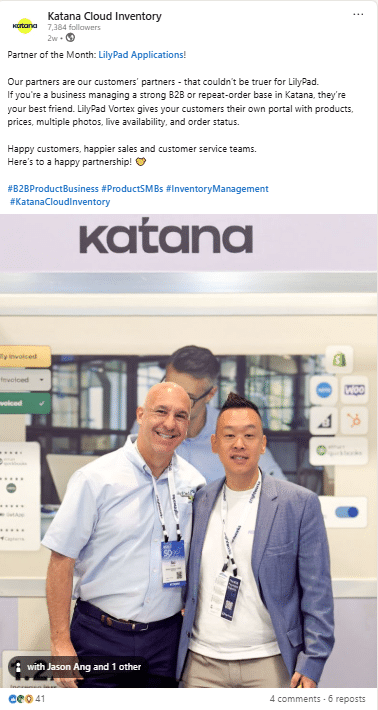

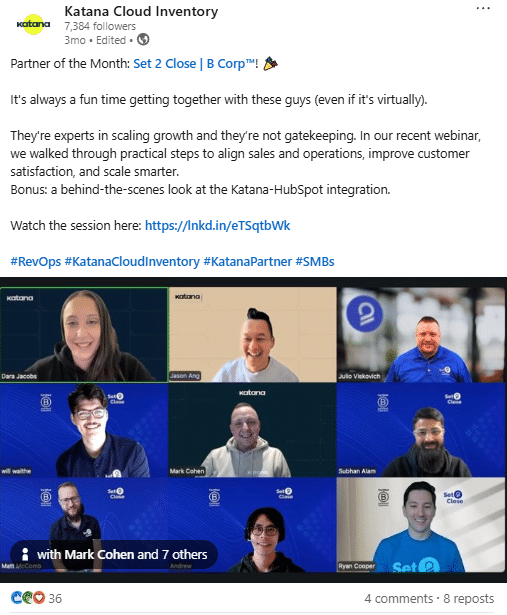

In the last 3 months, these are the top 3 posts from Katana’s LinkedIn page:

- partnership with LilyPad Applications, with 41 reactions, 4 comments, and 6 reposts.

2. partnership with Set 2 Close | B Corp, with 36 reactions, 4 comments, and 8 reposts.

3. participation at Inuit Connect, with 34 reactions, no comments, 1 repost.

Partnership announcements are winning because they signal ecosystem strength and third-party validation. When someone sees Katana partnering with established companies, it reduces perceived risk. The single-image format works better than carousels because LinkedIn’s algorithm favors native content that keeps people on the platform. Single images are easier to process and engage with quickly.

The fact that event participation is a top performer shows that their audience values real-world presence. Events like Intuit Connect mean Katana is serious enough to show up physically, network, and be part of industry conversations. This is especially important for mid-market software, where buyers want to know you’ll be around in 5 years.

These are Katana’s Instagram top posts in the last 3 months:

- carousel with pictures from Christmas party, with 25 likes, no comments, shares, or reshares.

2. carousel with pictures also from the kid-friendly Christmas party, with 22 likes, no comments, shares, or reshares.

3. carousel with pictures from a filming day featuring their CEO and COO, with 22 likes, 1 comment, no shares or reposts.

Instagram engagement on company culture content confirms this channel is for employer branding, not customer acquisition. The Christmas party posts with kids humanize the company. The filming day teaser creates anticipation. These work for recruitment because candidates research the company culture. They don’t work for B2B buyers looking for inventory software.

Carousel format performs best on Instagram because it encourages interaction (swiping through photos). But 22-25 likes with 1.7k followers is still only 1.3-1.5% engagement. That’s acceptable for employer branding but not so great for customer acquisition.

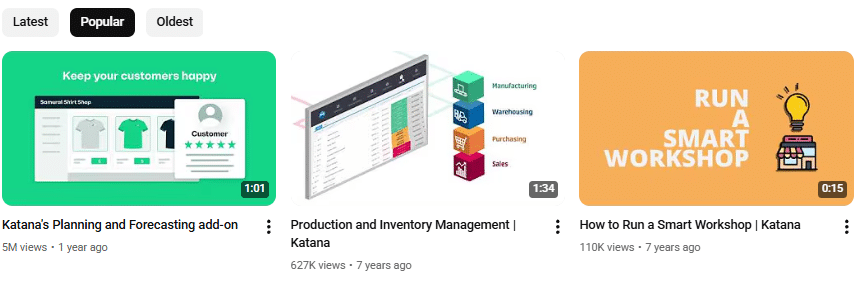

YouTube

Katana’s all-time top videos are:

- Katana’s Planning and Forecasting add-on, 5 million views, 5 likes, no comments

- Production and Inventory Management | Katana, 627k views, 181 likes, 11 comments

- How to Run a Smart Workshop | Katana, 110k views, 9 likes, no comments

They are short-length videos (up to 1:34 minutes). The fact that they have many views, but few likes or comments, suggests that these videos were used as non-skippable ads.

This is brilliant repurposing. Create product tutorial videos for customers, then run them as unskippable YouTube ads for prospects. You’re getting double value from one piece of content. The view-to-engagement ratio (5 million views, 5 likes) confirms these weren’t organically discovered. They were forced views from ads. That’s fine. The goal wasn’t engagement. It was awareness and education.

Short format (under 2 minutes) is perfect for ads. You’re not asking for 10 minutes of someone’s attention. You’re showing them one specific feature or use case quickly. The Planning and Forecasting add-on video, getting 5 million views, suggests Katana was specifically targeting people interested in that functionality.

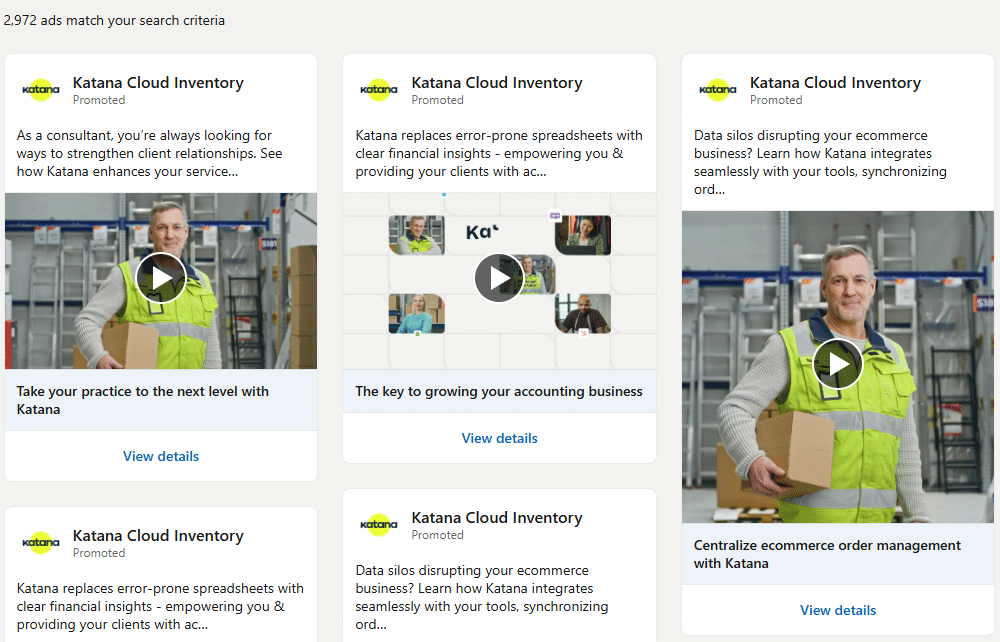

Katana’s Paid Advertising Strategy

Paid advertising reveals where companies invest acquisition budget and what messages they test in the market. Ad copy, creative formats, and platform selection show you what’s working at scale, not just what sounds good in theory. This is real market validation with dollars behind it.

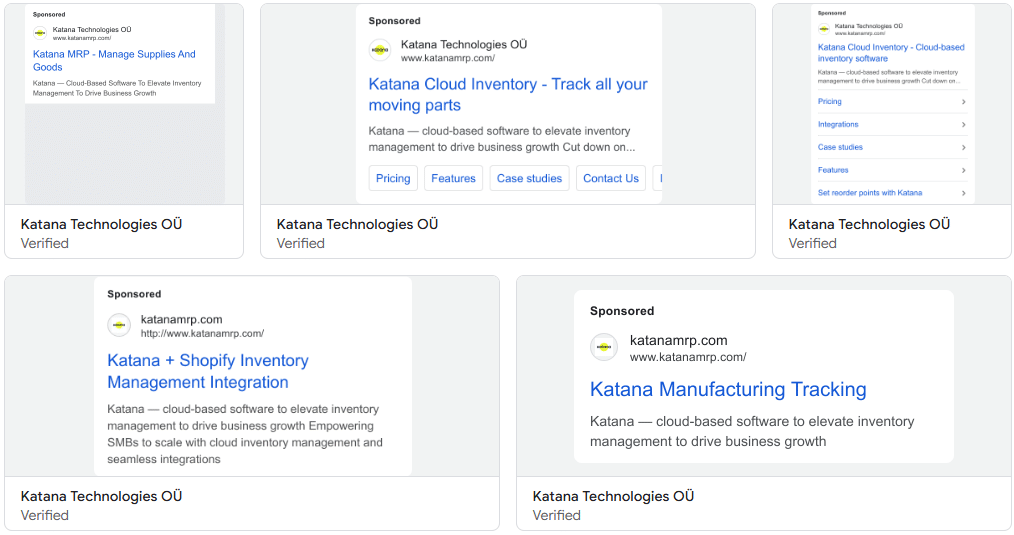

On LinkedIn, Katana is currently running 2.9k ads. Most of them are using the same videos, but with other copy. The videos end with “Katana integrates your operations and streamlines your workflows. Grow your business with Katana. Book a demo today.”

These are a few of the copy used in these ads:

- As a consultant, you’re always looking for ways to strengthen client relationships. See how Katana enhances your service offering with clear, actionable data and efficient workflows.

- Katana replaces error-prone spreadsheets with clear financial insights – empowering you & providing your clients with accessible inventory management.

- Data silos disrupting your ecommerce business? Learn how Katana integrates seamlessly with your tools, synchronizing orders and centralizing data from all your business apps.

- Keep your retail business connected with Katana at the center of your operations. Learn how our native integrations and an open API ensure real-time data flow across all platforms.

- Rapid growth can overwhelm your operations, but it shouldn’t have to. Discover why Katana is the #1 manufacturing software for supporting your way of working. Inefficient inventory management disrupting your business? Learn how Katana helps you easily increase SKUs and orders without complicating or changing your business processes.

Running 2.9k ad variations is sophisticated testing at scale. They’re running controlled experiments across different personas (consultants, ecommerce, retail, manufacturers) with the same video creative but different copy. This lets them isolate what messaging resonates with each audience without creating entirely new video assets. It’s efficient and data-driven.

According to 2025 LinkedIn Ads benchmarks, the platform achieved 113% ROAS (return on ad spend) for B2B SaaS, outperforming Google Search (78%) and Meta (104%). This means LinkedIn delivers $1.13 for every $1 spent, making it the only major platform with positive returns for B2B advertisers. The study also found that industry-specific campaigns with vertical-focused social proof outperform generic messaging by 15-20%, which explains why Katana runs different copy for consultants, retailers, and manufacturers instead of one-size-fits-all ads.

Every ad ends with “Book a demo today” because that’s their conversion goal. They’re not optimizing for downloads, free trials, or newsletter signups. They want sales conversations. This is a high-touch sales motion. The demo is where they qualify leads and customize solutions. The ads are lead generation, not self-serve conversion.

Their Headlines look like this:

- Eliminate stockouts and overstock with Katana

- Manufacturing management made seamless

- Improve inventory turnover and reduce carrying costs

- The key to growing your accounting business

- Take your practice to the next level with Katana

- Centralize ecommerce order management with Katana

These headlines speak directly to pain points (stockouts, overstock, carrying costs) and outcomes (improved turnover, centralized management). They are relying on the benefits of the platform, not its features. This is conversion copywriting 101, but it’s surprising how many B2B companies still lead with features instead of outcomes.

We couldn’t find any Meta ads from Katana. Considering the fact that both Facebook and Instagram is about Katana’s team and company culture, they don’t see the point in promoting these posts or creating special ads, probably because their ideal customers are not active on these channels.

This is a strategic resource allocation decision. Instead of spending the budget on channels where your ICP doesn’t hang out, focus on places where conversion actually happens. And in their case, we talk about LinkedIn and Google.

They also have no ads on Google Maps or Google Play. No Google Maps ads make sense for B2B SaaS. That’s for local businesses. No Google Play ads show they don’t have a mobile app, and it’s not a primary acquisition channel. Most inventory management happens on desktops, so mobile app promotion wouldn’t drive meaningful conversions.

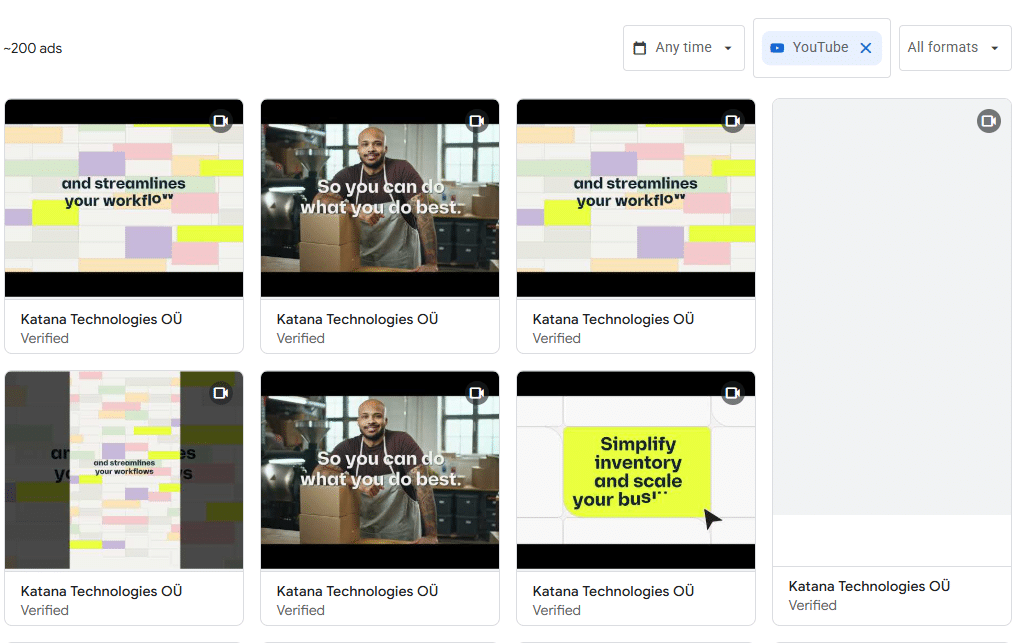

YouTube

On YouTube, Katana is currently running ~200 ads. Most of them are videos, probably used for the unskippable ads, with only a few text ads.

Headlines used in YouTube ads:

- Katana Cloud Inventory – Track all your moving parts

- Katana Cloud Inventory – Cloud-based inventory software

- Book a Demo Today – Integrate Your Favorite Tools

YouTube ads target people actively searching for solutions or watching content related to business operations, manufacturing, and ecommerce. Video ads on YouTube work because you’re reaching people in learning mode. They’re watching how-to videos or industry content. An inventory management ad in that context feels relevant, not disruptive.

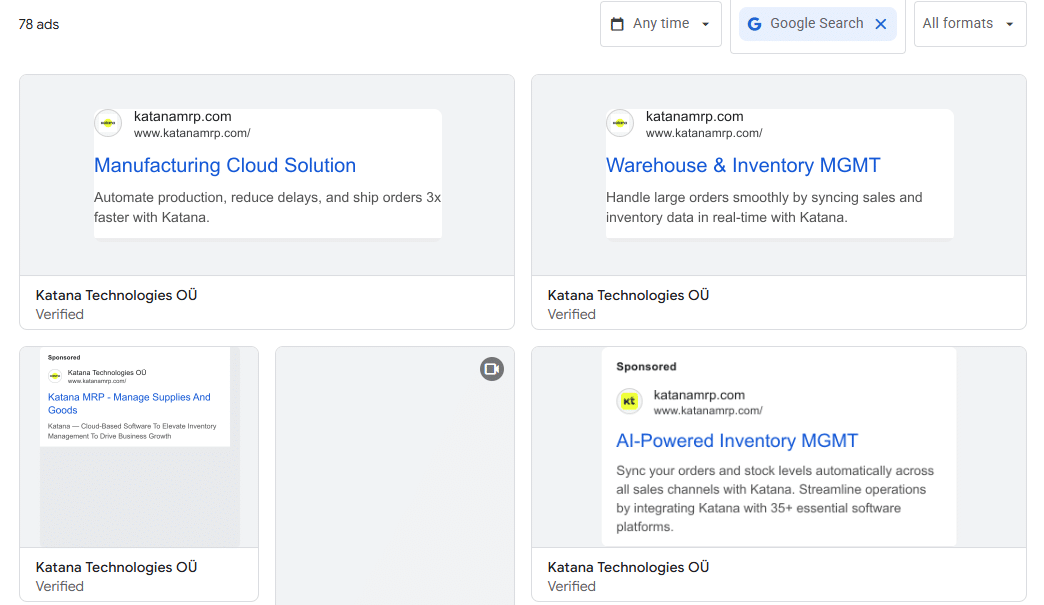

On Google Shopping, Katana has 10 ads running in text format.

Headlines used:

- Katana Cloud Inventory

- 1 Shopify Order Management Software — Katana

- Katana + Shopify Inventory Management Integration

- Katana Manufacturing Tracking

- Katana Cloud Inventory – Cloud-based inventory software

- Katana MRP – Manage Supplies And Goods

Google Shopping ads seem odd for B2B software until you realize people search “Shopify inventory management” when evaluating options. These ads capture bottom-funnel intent. Someone searching for “Shopify order management software” is actively looking for a solution right now. That’s high-intent traffic worth bidding on.

On Google Search, Katana has 78 ads running, most of them in text format.

Some of their headlines are:

- Manufacturing Cloud Solution

- Warehouse & Inventory MGMT

- AI-Powered Inventory MGMT

- Manufacturing Cloud Solution

- AI-Powered Stock Management

- Outgrow Fishbowl? Switch Now – Stop Stockout Headaches – Intuitive & Powerful MRP

- Don’t Settle for Cin7. See Why – See Why Businesses Choose Us – 60% Higher Sales on Average

- Katana: Inventory Solved

- #1 Ecomm Inventory Solution

The competitive headlines are aggressive conquest marketing. They’re bidding on competitor keywords to intercept prospects already looking for similar solutions. Someone searching for Cin7 or Fishbowl alternatives is ready to buy. Katana is making sure they consider another option before committing.

“60% Higher Sales on Average” in ad copy brings credibility through specificity. Vague promises don’t convert. Concrete numbers do. They’re using their best customer outcome data as social proof in ads.

Katana’s Sales Funnel from Social Media

Understanding how each social channel contributes to the sales funnel reveals where to invest resources and what content to create. Not every channel needs to drive direct conversions. Some build awareness, some nurture consideration, some close deals. The key is knowing which does what.

As we said, on some posts, links are dropped in the description, using CTAs like: Free download here, Visit the blog for the full breakdown, Register here, Save your spot, or Read the article here. The links open reports and ebooks to download, external and internal articles, and registration pages for webinars.

Articles are completely free, but webinars and reports require at least your name and email address. Reports and ebooks are gated by other criteria like annual revenue or industry. They are using education to convert. Maybe the content is so good that it will convince you to book a demo. But it’s not on your face. You don’t see any links to the product page. For this, they have LinkedIn ads, with the Book a demo today CTA for that.

LinkedIn is doing triple duty: awareness (organic posts reach followers), consideration (blog links educate prospects), and conversion (ads drive demo bookings). The partnership posts that perform best are building trust at the awareness stage. When prospects see those posts multiple times over weeks, Katana becomes a familiar name. Then, when they hit a pain point, they remember THAT company that partners with everyone.

The remarketing play here is subtle but powerful. Everyone who engages with organic posts can be retargeted with ads. So those 30 people liking partnership announcements? They’re now in an audience that sees ads for the next 90 days. This is how you turn modest organic engagement into a qualified pipeline.

Facebook & Instagram

These platforms are doing something completely different. They’re not selling here at all. It’s pure employer branding and culture content. Christmas parties, office events, team bonding.

The “funnel” here, if you can call it that, is more about recruitment. Current customers and potential employees see these posts, not prospects. That’s probably why they’re not running any Meta ads. They know their audience isn’t scrolling Instagram looking for inventory management software.

The mistake would be treating all social channels the same. LinkedIn is for customers. Instagram is for candidates. YouTube is for education. Each has a different goal, a different audience, different content strategy. The problem is when Instagram isn’t converting to hires AND isn’t converting to customers. Then it’s just activity without outcomes.

YouTube

In the YouTube video description, you can find mostly links to their Knowledge Base or setup guides. Only on the most popular videos you will find a link to their website and their social media (Facebook, X, and LinkedIn).

Having many structured playlists makes the adoption easier. Anyone who watches multiple tutorial videos is probably serious about implementing the software. These people either convert to a free trial or request a demo. You’re not creating separate content for pre-sale and post-sale. The same videos serve both, which reduces production costs and creates consistency.

Even though there is no strong CTA like Book a demo now, if you are already looking at Katana’s videos, you either are already a customer or consider becoming one. You already know about them and where to find them. The links don’t have direct buttons, but by clicking around, you will find the hero page, where the Get started for free button is waiting for you.

The tutorial structure is lowering support costs while enabling self-service evaluation. Prospects can answer their own questions without contacting sales. Customers can solve problems without opening support tickets. Both reduce operational costs and speed up the buyer journey.

Katana’s Reviews and Social Proof

Reviews are the reality check on marketing promises. High ratings validate messaging. Low ratings reveal product-market fit issues or operational problems. Review sentiment across platforms tells you if customers love the product but hate support, or vice versa. This intel should directly inform the product roadmap and customer success strategy.

G2: 4.4 / 5

G2 is where B2B buyers do research. A 4.4/5 rating is great, but not exceptional. It won’t eliminate you from consideration, but it won’t make you the obvious choice either. For GTM, the question is: what keeps it from being 4.7 or 4.8? Reading negative reviews reveals where the product or service falls short of expectations. Those gaps are either product roadmap items or sales messaging problems.

Trustpilot: 2.4 / 5

Recent reviews explained thoroughly why they chose to leave Katana after 2 or even 6 years. The reason is mostly changing the business model, especially the pricing model (sudden price changes). They also complain that maybe Katana is not the best choice for small manufacturers.

This is a red flag. 2.4/5 on Trustpilot, with customers leaving after 6 years because of pricing changes, is a customer success and communication failure. Long-tenured customers are your most valuable. They’ve invested in your product, integrated it into operations, and likely referred others. Losing them to pricing changes means either the pricing was communicated poorly or the value didn’t justify the increase.

This contradicts their marketing positioning. If your ads target SMBs but your product has outgrown that market, you’ve got a GTM alignment problem. Either reposition upmarket and change messaging, or fix the product to serve SMBs better. You can’t keep selling to a customer segment that’s unhappy with your offering.

According to 2025 SaaS benchmarks, median customer acquisition costs increased 14% year-over-year, with companies now spending $2.00 to acquire $1.00 of new ARR (annual recurring revenue). Rising CAC (customer acquisition cost) forces tough decisions: either increase prices, reduce customer acquisition spend, or accept lower margins. Katana’s pricing changes, which frustrated long-time customers, likely reflect this industry-wide pressure. The challenge is that they haven’t communicated this economic reality effectively, so customers see price increases without understanding the why behind them.

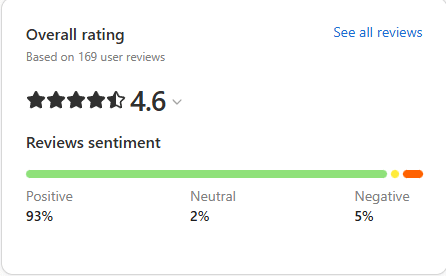

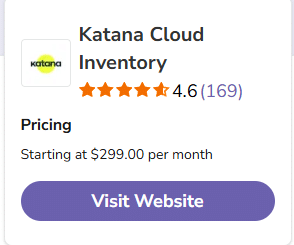

Capterra: 4.6 / 5

Insights show that reviewers have a small business owners, mostly entrepreneurs. Top industries are:

- Food & Beverages

- Food Production

- Retail

- Consumer Goods

Software Advice: 4.6 / 5

Here, the complaints we saw on Trustpilot are repeated: the pricing system is not great for small businesses. The same complaints across multiple platforms mean this isn’t isolated feedback. This is a pattern. This needs immediate addressing. Either through transparent pricing communication, grandfather clauses for existing customers, or clearer messaging about who Katana is actually built for.

GetApp: 4.6 / 5

On GetApp, people praise Katana for its visibility, assistance, and simplicity. Complaints are mostly about affordability, flexibility, and escalation. The pros confirm their marketing message is accurate. They promise simple, clear inventory management, and customers agree that’s what they get. Affordability as a con reinforces the pricing concern.

On Glassdoor, Katana has 4.3 / 5 stars rating. 81% of employees would recommend this company to a friend, and 85% approve of the CEO. The lowest rated category is career opportunities (3.9), and the highest is work/life balance (4.5). Katana replies to these reviews, but not about their product, on other platforms.

Strong Glassdoor ratings matter for GTM because happy employees deliver better customer experiences. When work/life balance is rated highest, that suggests a sustainable pace, which reduces burnout and turnover. Low turnover means sales reps maintain account relationships, and customer success keeps customers longer.

Katana’s Content Marketing and Demand Generation

Use Cases

Katana has use cases for: manufacturing, retail, ecommerce, wholesale, distribution, and more. On every page, you will see how Katana can help you and how it’s applied to your case. You can also sort it by industries like: apparel, cosmetics, electronics, food & beverage, and others.

Use cases by vertical and business type are essential for enterprise sales, but also work for SMB self-service. When a cosmetics manufacturer lands on your site, they don’t want to translate generic inventory management into their specific context. This accelerates evaluation because prospects see themselves in the content.

From a demand gen perspective, use case pages are SEO gold. Someone searching “inventory management for food production” should land on Katana’s food & beverage use case page, not the generic homepage. Each use case page is a landing page optimized for a specific search intent. This is how you capture bottom-funnel organic traffic.

On this page, you can find customer success stories. The articles are around 5 minutes of reading time. On each page, you will see company info and integrations used. Quotes from the owners are scattered throughout the article.

Before reading the article, you will find exactly how Katana helped these companies, providing outcomes like:

- 60% production planning increase

- 29% improved inventory accuracy

- 1-2 day shipping with WooCommerce and Katana

- -4hours weekly manual updates

Leading with outcomes before the story is brilliant. Most case studies bury the results at the end. Katana puts them upfront: 60% increase, 29% improvement, 4 hours saved. If those numbers resonate, you read more. If not, you bounce quickly. This respects the reader’s time and improves engagement metrics because people who read are genuinely interested.

💡 Steal This: Restructure your case studies. Start with a results snapshot (3-5 bullet points with percentages and timeframes). Then customer quote. Then challenge/solution/outcome narrative. End with specific tactics they used. Make it scannable in 30 seconds, readable in 3 minutes.

Showing integrations used in each case study helps prospects with similar tech stacks self-qualify. “This company uses WooCommerce and Katana for 1-2 day shipping? We use WooCommerce too. Maybe this works for us.” That’s powerful social proof that’s more specific than generic testimonials.

The Business Tips section is designed to help you streamline how you run your company. Whether you’re looking for a complex article or a quick one, they’ve got you covered. Some guides are more technical and take about 20 minutes to read, and some are on simpler topics that can be finished in 10 minutes.

To help you navigate, you’ll find the TOC on the right side of every article. These posts are text only, no videos or screenshots, just straightforward advice to help you out.

Long-form educational content is top-of-funnel SEO content. People searching “how to improve inventory turnover” aren’t ready to buy. They’re learning. Katana shows up, provides value, and plants a seed. When that person is ready to buy 3-6 months later, they remember who taught them. This is demand generation through thought leadership.

No screenshots or videos in blog posts is a missed opportunity. Text-only content is harder to scan and less engaging. Adding relevant product screenshots would naturally introduce the product without being salesy.

On this page, you’ll find an article that contains everything you need to know about inventory management to help you take your game to the next level. The TOC:

- What is inventory management?

- Tips for managing your inventory

- Inventory management techniques and strategies

- Inventory management challenges

- Implementing technology in inventory management

- Inventory management systems

- Inventory management software for total inventory control

You can also download the ebook that covers everything you need to know about the subject. The guide can be sent to your email address if you complete the form with your email, name, annual revenue, and industry.

They also specify that “we’ll also send occasional helpful tips, and you can unsubscribe any time.” That means that you will be automatically subscribed to their newsletter.

Gating comprehensive guides behind a form is a lead magnet. The guide provides genuine value (it’s not a disguised sales pitch), but Katana gets email, revenue, and industry data in return. That data enriches their CRM and enables segmented follow-up. Someone from food & beverage can get different nurture emails than someone from electronics.

Being transparent about newsletter subscription is good practice. GDPR aside, surprising people with unexpected emails tanks deliverability and increases unsubscribes. Better to set expectations upfront.

Another blog category is Company News. Here you can read short articles (2-5 minutes read) on Katana’s updates. The last articles are from 2024. They were usually written by James Humphreys (Head of Content Marketing), Shawn Coultice (Head of Channel Partnerships), Riikka Söderlund (COO & CMO), or by the Katana Team.

Company news is mostly for existing customers and partners, not prospects. Announcing new features, partnerships, and funding rounds keeps stakeholders informed and reinforces that Katana is growing and investing in the product. The fact that the last articles are from 2024 suggests either they deprioritized this content or consolidated it elsewhere.

Multiple authors (Head of Content, Head of Partnerships, COO/CMO) show cross-functional content ownership, which is good. Different leaders sharing company news from their perspective adds credibility.

Company News and Business Tips are 2 categories that are featured separately on their footer section. Here you can find Product Updates, too. Besides that, you can also find articles with Inventory management, Accounting, and Manufacturing tags.

In the past, they were not consistent with these posts. We have some in August, then in October, but from December, they try to post multiple times per month. Inconsistent posting shows either resource constraints or shifting priorities. For SEO and audience building, consistency matters more than volume. It’s better to publish weekly forever than to publish daily for a month, then go dark. The algorithm and your audience both reward consistency.

The majority of the last articles were written by Andreia Mendes, their Senior Content Writer, from September 2025.

Katana’s Marketing and Sales Funnel Stages

Top of the Funnel

Katana casts a wide net here. YouTube ads (200 running) and LinkedIn ads (2.9k running) grab attention with pain points: stockouts, data silos, spreadsheet chaos. Blog content on Business Tips gives general inventory management advice without pushing the product hard. The Use Cases section lets people self-identify their industry and see if Katana fits.

The Inventory Management Guide is a lead magnet. You get the ebook, they get your email, industry, and revenue info. You’re also auto-subscribed to their newsletter, which keeps you in the funnel.

TOFU content is focused on education, not conversion. They’re not trying to close deals with blog posts. They’re trying to get people to raise their hand and say “I have this problem”. The lead magnet strategy is smart because it segments prospects early. When someone downloads the manufacturing guide, you know their use case. That informs what emails and ads they see next.

Auto-subscribing people to the newsletter after downloading content is aggressive, but standard. The key is what happens next. If they blast promotional emails immediately, people unsubscribe. If they send valuable educational content for 2-3 weeks before pitching demos, conversion rates go up. The nurture sequence matters more than the initial capture.

Middle of the Funnel

This is where Katana Academy becomes central. Once you’re interested, you can explore the Knowledge Base, watch the Video Library, or run through Interactive Demos. These demos walk through specific processes (inventory management, sales orders, manufacturing) so prospects can visualize using the product.

Case Studies show real results (60% production planning increase, 29% improved inventory accuracy). Webinars get promoted across LinkedIn and by leadership, creating multiple touchpoints. The pricing calculator lets people see exact costs before talking to sales, which qualifies leads.

The 15-day free trial with full product access is the big MOFU play. You can test up to 30 SKUs and 3 locations, plus API access. That’s enough to know if it solves your problem.

MOFU is about building confidence and removing objections. Case studies provide social proof. Webinars let prospects ask questions in a low-pressure environment. The pricing calculator removes the pricing objection before it kills the deal. All of this is self-service, meaning prospects can move through evaluation at their own pace.

The free trial is generous because it needs to create conviction. If the trial is too limited, prospects can’t validate fit. Then they need to talk to sales before committing, which slows everything down. By offering full functionality with reasonable limits (30 SKUs, 3 locations), Katana lets small-to-midsize businesses fully test the product. The ones who max out the trial limits are your best customers. They’re already using it hard

Bottom of the Funnel

Book a demo button is everywhere: website, ads, video endings. For businesses over 50k monthly sales orders, a demo is required (no self-serve pricing). This is intentional. High-volume businesses need custom solutions and bigger contracts.

The Partner Program creates another path. Accounting firms and consultants who see Katana working for multiple clients become advocates and drive referrals. Integration Partners get demo accounts and supporting materials to pitch Katana, basically creating a sales force outside Katana’s team.

BOFU is where sales gets involved for high-value deals. Sales needs to understand the prospect’s tech stack, integrations, pain points, and budget. Then they configure a solution and price it appropriately. This is why forcing 50k+ order volume businesses into demos makes sense. These deals need humans.

Every partner that successfully sells Katana to a client becomes more motivated to sell again. They learn the product, understand the ICP, and build it into their service offerings. This creates geometric growth. One partner can drive 10 deals/year without Katana hiring more sales reps.

Retention

Katana Academy continues grinding long after purchase. This is the main retention tool. Customers come back for courses, troubleshooting articles, and new feature tutorials. The interactive demos help with onboarding new team members.

The Partner Directory and Developer Portal keep technical users engaged. Companies that build custom integrations or workflows are less likely to churn. They’ve invested time making Katana work perfectly for their needs. Add-ons (Traceability, Warehouse Management, Manufacturing Management, Shop Floor App) create expansion revenue. You start with base Katana, then add modules as you grow.

According to a 2025 analysis, top SaaS companies generate 50%+ of new ARR from existing customer expansion. Benchmarks show median NRR (net revenue retention) sits at 106%, while top performers exceed 120%. By offering modular add-ons that customers adopt as they scale, Katana is building an expansion engine that could drive 40-60% of new ARR from existing accounts rather than chasing new logos.

Retention is where most SaaS companies fail. They spend all their energy on acquisition, then ignore customers after close. Katana built retention into the product through modular add-ons and into their content through Academy. The add-on strategy means every customer has expansion potential.

Katana’s Future Plans and Growth Indicators

Right now, there are only 2 open positions: Senior Software Engineer (Estonia, full time, hybrid), and Senior GTM Operations Manager (Europe, Poland, Portugal, full time).

Part of their compensation package? Stocks, sabbatical (after 4 years in the company), 4 weeks annual time-off, and 3 paid health days.

On Katana’s LinkedIn page, the GTM Manager (Estonia) position is the only one posted.

According to 2025 B2B SaaS research, companies with strong sales and marketing alignment see 67% higher close rates and 19% faster revenue growth. The study emphasizes shared definitions for qualified leads and weekly pipeline reviews (exactly the kind of operational rigor a GTM Ops Manager would implement). With fresh Series B funding, but limited hiring, this role suggests they’re prioritizing quality of execution over quantity of headcount.

Inspiration Points

1. Katana Academy

Most SaaS companies have a help center. Katana built an entire education platform. Getting Started, Knowledge Base, Video Library, Interactive Demos, and Use Cases sorted by industry. This it’s a resource that makes customers successful, which is how you reduce churn.

Customer education directly impacts net revenue retention. When customers know how to use the product fully, they extract more value. More value means lower churn and higher expansion revenue (they buy add-ons). Companies that treat education as an afterthought leave money on the table.

2. The pricing transparency calculator

You can see the starting price ($299/month). You can play with the calculator to see your exact costs based on sales orders and inventory locations. No need to contact sales reps until you hit enterprise scale (50k+ orders). This qualifies leads and filters out tire-kickers before sales gets involved.

Transparent pricing reduces sales cycle length and improves close rates. When prospects know costs upfront, price objections come early (when they can self-disqualify) instead of late (after sales has invested hours in demos). This makes sales more efficient. Plus, prospects who book demos after using the calculator are pre-qualified. They know the price and are still interested.

3. The 15-day free trial

Full product access, 30 SKUs, 3 locations, API access included. You can actually test integrations and see if Katana works with your stack. Most trials are so limited that you can’t make a real decision.

Trial limits should be based on value thresholds, not feature restrictions. 30 SKUs and 3 locations is enough for a small manufacturer to run real operations for 15 days. That’s long enough to feel pain when the trial ends. Feature-restricted trials are annoying and don’t prove value. Katana’s approach proves value, which converts higher.

4. Use cases by industry

Instead of making everyone read generic product pages, you can jump straight to your industry (cosmetics, apparel, electronics, food & beverage). Each page shows exactly how Katana applies to your specific problems. This speeds up the buyer journey.

Vertical segmentation reduces time-to-value perception. When content speaks directly to your context, you don’t have to translate generic benefits into your specific use case. That mental work is friction. Removing friction accelerates evaluation. Plus, SEO benefits are huge.

5. Case studies lead with numbers

Before you even start reading, you see the results: 60% production planning increase, 29% improved inventory accuracy, 1-2 day shipping. That’s how you grab attention.

Outcome-first case studies respect reader time and improve engagement. Most people skim case studies looking for results. If results are at the end, people bounce before getting there. Leading with numbers also makes case studies more shareable. A sales rep can quickly pull “60% production planning increase” without reading the whole story.

6. The Partner Program as a sales force multiplier

Accountants and consultants who serve multiple small manufacturers become Katana advocates. They get revenue share, priority support, and influence on product development. This turns customers into salespeople who have credibility.

Channel partnerships scale revenue without scaling headcount. Every partner that successfully implements Katana for a client becomes incentivized to do it again. They learn the product, understand fit, and build it into their service offerings. One partner can drive 10-20 deals/year, which is equivalent to hiring a full-time sales rep without the salary, benefits, and management overhead.

7. LinkedIn ads speak to multiple personas

They’ve got specific copy for consultants, accounting firms, ecommerce businesses, and manufacturers. Each ad speaks directly to that persona’s pain points.

Persona-specific messaging increases conversion rates because relevance drives action. A consultant seeing “strengthen client relationships” resonates differently than a manufacturer seeing “eliminate stockouts”. Same product, different value propositions. This requires sophisticated audience segmentation and creative production, but the ROI justifies it.

8. YouTube content pulls double duty

Training videos for customers become top-of-funnel ads for prospects. Those 5 million view videos? They were non-skippable ads. Creating once and using twice is an efficient content strategy. Content repurposing multiplies ROI. By running tutorials as ads, Katana gets awareness and education value from content that was primarily built for retention.

9. Leadership is visible (when it counts)

CEO and co-CEO both announce webinars, share articles, and promote partnerships. They’re not posting daily thought leadership, but they show up for the important stuff. COO posts video recordings instead of text walls, which is more engaging.

Executive presence doesn’t require constant posting. It requires strategic visibility at key moments. When leaders show up for product launches, partnerships, and major announcements, it signals company priorities and builds credibility. Video builds personal connection better than text, and she’s leveraging her unique voice instead of sounding like the corporate account.

10. Integration ecosystem is the moat

Shopify, WooCommerce, BigCommerce, Amazon, HubSpot, Salesforce, Pipedrive, QuickBooks. The list goes on. Katana integrates with everything. The Developer Portal and Integration Partner program expand this ecosystem, making Katana stickier as customers connect more tools.

Integration breadth is both a sales tool and a retention mechanism. During sales, “integrates with your existing stack” removes a major objection. Post-sale, each integration connected increases switching costs. A customer using Katana with 5 integrations has to evaluate whether competitors support those same 5. Often they don’t, which means staying with Katana is easier than switching.

Katana’s marketing strategy reveals something important about modern B2B go-to-market: you don’t win by being everywhere. You win by being exactly where your ICP makes decisions.

They killed Facebook despite having 3.8k followers. They ignore Instagram for customer acquisition. They put zero budget into Meta ads. Instead, they went all-in on LinkedIn and Google, running 2.9k ads with persona-specific messaging that speaks directly to consultants, manufacturers, and ecommerce businesses.

The smartest play? Their Partner Program. Instead of hiring 50 sales reps, they turned accountants and consultants into referral engines. These partners already have relationships with Katana’s ideal customers. When your trusted advisor recommends software, you listen. That’s distribution leverage most companies never figure out.

But there’s a tension building. Reviews show long-time customers leaving because pricing changes pushed them out. You can’t market to SMBs while your product evolves upmarket. Katana needs to decide: are they serving small manufacturers or scaling to enterprise? The messaging and pricing need to match the actual product direction.

Series B funding with limited hiring suggests careful, strategic growth rather than the usual venture-backed sprint to burn cash on acquisition.

At Milk and Cookies Studio, we look at companies like Katana because there’s always something to learn. If you’re building or scaling a B2B SaaS company and need help designing a go-to-market strategy that actually converts, we’d love to talk.

We specialize in helping companies figure out which channels matter, what messaging resonates, and how to build systems that scale without breaking. Because at the end of the day, great marketing isn’t about doing everything. It’s about doing the right things really well.

Want to see how we could approach your GTM strategy? Let’s chat.

Frequently Asked Questions

- What does Katana actually do?

Katana is a cloud-based inventory management platform built for modern businesses that are stuck between spreadsheets and overkill ERP systems. They offer inventory management, manufacturing, purchasing, warehousing, and order management in one place. Founded in 2017 in Estonia, they raised $16.4 million in Series B funding in October 2025. Their pitch is simple: get exactly what you need without paying for bloated features you’ll never use.

2. How much does Katana cost?

Pricing starts at $299 per month, and they’ve got a pricing calculator so you can see exactly what it’ll cost for your business before talking to sales. Add-ons include Traceability ($249/mo), Warehouse Management ($149/mo), Manufacturing Management ($199/mo), and Shop Floor App ($199/mo). There are also fees based on monthly sales orders and inventory locations. If you’re doing over 50k monthly delivered sales orders, you’ll need to book a demo for custom pricing. They offer a 15-day free trial with full product access, up to 30 SKUs, and 3 inventory locations.

3. What makes Katana different from other inventory software?

Katana promises 60% higher sales year over year, 1.2x increase in inventory turnover, and 6 weeks to full implementation versus 6-12 months for most ERPs. They integrate with all your existing tools (Shopify, WooCommerce, Amazon, HubSpot, Salesforce, Pipedrive). Katana Academy gives you guided onboarding, courses, and support at your own pace. They also have a Partner Program for accounting firms and consultants, plus a Developer Portal for custom integrations.

4. Is Katana’s leadership active in the industry?

Sort of. CEO Kristjan Vilosius (3.5k LinkedIn followers) mostly reposts from Katana’s page with occasional original posts like Forbes articles he’s written. Former CTO Priit Kaasik (2.5k followers) stepped down to start a new company and posts more about AI and tech than Katana now. COO Riikka Söderlund (1.9k followers) posts video recordings about webinars and events. Co-CEO Ben Hussey (3.8k followers) is the most consistent, posting or reposting about Katana weekly. They show up when it matters but aren’t flooding feeds with thought leadership.

5. Where is Katana most active on social media?

LinkedIn is their main channel with 7k followers. They post 2-5 times per week using images, carousels, and videos. Content focuses on webinars, blog posts, company culture, and events. Engagement is modest (around 30 reactions per post). Facebook (3.8k followers) hasn’t been updated since April 2025. Instagram (1.7k followers) posts weekly about company culture and team events with minimal engagement. YouTube (2.3k subscribers, 6 million views) is their education hub with 258 videos including training, webinars, and their podcast Stock Takes. X (4.4k followers) has been inactive since 2023.

6. What content performs best for Katana?

On LinkedIn, partnership announcements get the most engagement, and single-image posts work best. On Instagram, carousels showing company culture (Christmas parties, team events) get 20-25 likes. On YouTube, their top three videos have millions of views but low engagement, suggesting they were used as non-skippable ads. Product training videos like “Planning and Forecasting add-on” hit 5 million views, while practical guides like “Production and Inventory Management” got 627k views with actual engagement.

7. How aggressive is Katana with paid advertising?

Very aggressive on LinkedIn and YouTube, invisible on Meta. They’re running 2.9k LinkedIn ads with targeted copy for consultants, retailers, manufacturers, and ecommerce businesses. Every ad ends with “Book a demo today”. On YouTube, they’re running around 200 ads, mostly videos used as non-skippable ads. Google Shopping has 10 text ads, Google Search has 78 text ads. Zero ads on Facebook, Instagram, or Google Maps. They know where their ICP spends time.

8. What do customers actually think about Katana?

Reviews are mixed depending on the platform. G2 gives them 4.4/5, Capterra 4.6/5, Software Advice 4.6/5, GetApp 4.6/5. But Trustpilot only gives them 2.4/5. The main complaints? Sudden pricing changes and their shift in business model has frustrated long-time customers. Several reviews mention leaving after 2-6 years because Katana is pricing out small manufacturers. Pros are visibility, assistance, and simplicity. Cons are affordability, flexibility, and escalation. As an employer, they score 4.3/5 on Glassdoor with 81% of employees recommending them.

9. What kind of content does Katana create for marketing?

They’ve got Use Cases sorted by business type (manufacturing, retail, ecommerce) and industry (apparel, cosmetics, electronics, food & beverage). Case Studies feature customer success stories with concrete results upfront (60% production planning increase, 29% improved inventory accuracy). Their Business Tips blog has complex articles (10-20 minute reads) on inventory management best practices. The Inventory Management Guide is a comprehensive ebook used as a lead magnet. Company News blog covers product updates and announcements. Most recent content is written by Andreia Mendes.