GTM Strategy for Tech Companies: B2B Go-to-Market Guide with Real Examples

Article summary

Share

This comprehensive guide covers proven go-to-market strategies specifically designed for B2B tech companies, including step-by-step frameworks, real-world examples from successful companies like Slack and Zoom, essential marketing plan components, measurement tools, and common pitfalls to avoid when launching tech products.

Launching a tech product without a solid go-to-market (GTM) strategy is like building a rocket without a flight plan. You might have a great product, but without a clear path to market, you’re likely to crash and burn. This guide provides a battle-tested framework for B2B tech companies, offering actionable steps and real-world examples to help you navigate the complexities of the tech market and drive sustainable growth. Let’s dive into what actually works.

What is a go-to-market strategy for tech companies

What is a go-to-market strategy?

A go-to-market strategy is your comprehensive blueprint for launching products and capturing market share in the tech space. It’s the operational playbook that connects your product development efforts to actual revenue, where engineering meets market reality.

For tech companies, your strategy addresses the unique challenges of selling complex solutions to sophisticated buyers. You’re not marketing features; you’re selling transformation, integration capabilities, and long-term partnerships. Your approach must account for lengthy sales cycles, multiple stakeholders, and the technical validation process B2B buyers demand.

What sets a tech-focused approach apart is the emphasis on product-market fit validation, technical proof points, and articulating ROI in concrete terms. You demonstrate not just what your solution does, but how it integrates into existing tech stacks, scales with growth, and delivers measurable business outcomes. This requires alignment across product, engineering, sales, and customer success teams. Everyone needs to understand the target customer’s technical environment and business challenges.

Now that we’ve defined what a GTM strategy is, let’s explore the approaches that are actually delivering results for B2B tech companies in today’s competitive landscape.

GTM strategies that actually work for B2B tech companies

The most successful B2B tech companies use a combination of approaches rather than betting everything on a single channel.

Proven B2B go-to-market strategies

- Product-led growth: Offer a freemium model or free trial that lets prospects experience value before committing budget. This removes friction from the buying process and lets your product sell itself. Companies like Slack and Dropbox proved this model, and it’s now table stakes for many software categories. The key is ensuring your free tier delivers genuine value while creating clear upgrade paths.

- Content-driven demand generation: Create educational content addressing specific pain points your prospects face: technical guides, implementation frameworks, and ROI calculators. This positions you as a trusted advisor rather than just another vendor. Use HubSpot or Marketo to track engagement and identify high-intent prospects based on their content consumption patterns.

- Account-based marketing (ABM): Identify your ideal accounts and create personalized campaigns for each one. Tools like Demandbase or 6sense help you orchestrate these targeted efforts across multiple channels. This approach works because enterprise deals require consensus from multiple stakeholders, and ABM lets you address each decision-maker’s specific concerns.

- Strategic partnerships: Partner with complementary technology providers, system integrators, or consulting firms that already have relationships with your target customers. These partnerships give you access to established distribution channels and third-party validation that prospects trust.

Content-driven demand generation remains essential for complex B2B solutions. Account-based marketing (ABM) delivers the highest ROI when targeting enterprise accounts. Instead of casting a wide net, you identify your ideal accounts and create personalized campaigns for each one.

With these effective strategies in mind, let’s break down the step-by-step framework I use with my tech clients to build a winning go-to-market strategy.

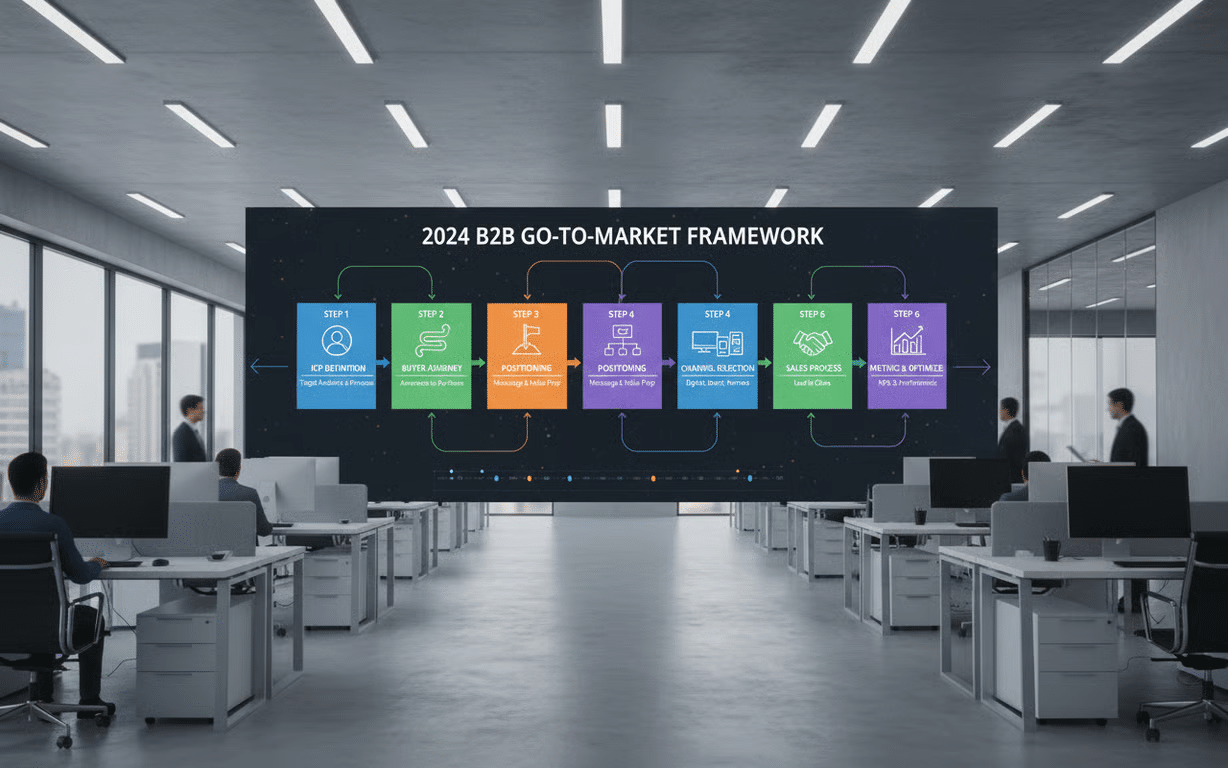

How to build a go-to-market strategy: step-by-step framework

Here’s the framework I use with tech clients, broken down into actionable steps you can implement immediately.

Step-by-step go-to-market process

- Define your ideal customer profile (ICP): Identify the specific companies and roles that get maximum value from your solution. Consider firmographics like company size, tech stack, growth stage, and budget authority. Create detailed profiles including technical requirements, business challenges, and buying process for each segment. Use your CRM data and tools like LinkedIn Sales Navigator to validate these profiles against real market data.

- Map the buyer’s journey: Document every stage your prospects go through from initial awareness to closed deal. Identify the questions they ask, objections they raise, and information they need at each stage. Interview your recent customers and lost deals to understand the actual journey. Use this intelligence to create content and sales enablement materials that address specific concerns at the right time.

- Craft your positioning and messaging: Develop a clear value proposition that differentiates you from alternatives. This means understanding not just your direct competitors, but also the status quo and DIY solutions your prospects might consider. Your messaging should articulate the specific business outcomes you deliver, not just product features. Test this messaging with prospects before you scale it across all channels.

- Select your channels and tactics: Choose 2-3 primary channels based on where your ICP spends time and how they prefer to buy. For technical audiences, this might be developer communities, GitHub, or technical blogs. For executive buyers, focus on LinkedIn, industry events, and analyst relations. It’s better to dominate a few channels than to have weak presence everywhere.

- Build your sales process: Document your sales methodology, qualification criteria, and deal stages in your CRM (Salesforce, HubSpot, or Pipedrive). Define what constitutes a qualified lead, the typical deal cycle length, and the resources required to close deals. Create sales playbooks that outline discovery questions, demo scripts, and objection handling for common scenarios.

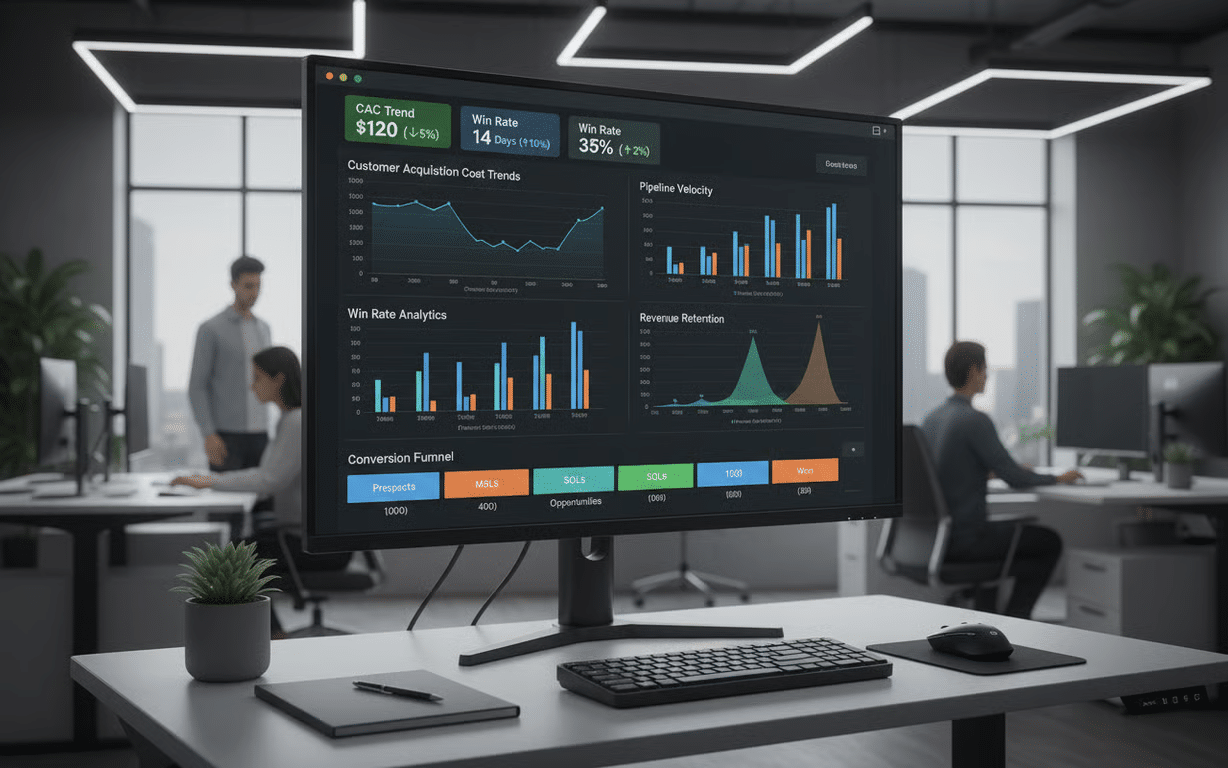

- Establish success metrics: Define the KPIs that matter for your business model. Track metrics like customer acquisition cost (CAC), sales cycle length, win rate, average contract value (ACV), and pipeline velocity. Set up dashboards in tools like Looker or Tableau so you can monitor performance in real-time and make data-driven adjustments.

Now that you have a framework for building your GTM strategy, let’s look at the essential components of a marketing plan that will bring that strategy to life for your tech product.

Go-to-market marketing plan essentials for tech products

Your marketing plan needs to translate strategy into executable campaigns. Here’s what must be included.

Essential components of a go-to-market marketing plan

- Target account list: Build a prioritized list of companies that match your ICP. Use intent data from tools like Bombora or G2 to identify accounts actively researching solutions in your category. This list drives all your marketing activities and ensures you’re focusing resources on the highest-potential opportunities.

- Content strategy: Map content assets to each stage of the buyer’s journey. Early-stage prospects need educational content about the problem space. Mid-stage buyers want comparison guides and case studies. Late-stage prospects need ROI calculators, security documentation, and implementation guides. Create a content calendar that ensures you’re consistently publishing relevant material.

- Channel mix and budget allocation: Determine how you’ll split your budget across paid advertising, content marketing, events, and partnerships. For most B2B tech companies, I recommend allocating 40% to content and SEO, 30% to paid channels like LinkedIn and Google Ads, 20% to events and partnerships, and 10% to experimentation with new channels.

- Campaign calendar: Plan your major campaigns quarterly, aligning them with product releases, industry events, and seasonal buying patterns. Each campaign should have clear objectives, target accounts, messaging themes, and success metrics. Use project management tools like Asana or Monday.com to coordinate across teams.

- Technology stack: Ensure you have the right tools to execute and measure your plan. At minimum, you need a marketing automation platform (HubSpot, Marketo, Pardot), a CRM, analytics tools (Google Analytics 4, Mixpanel), and ABM software if you’re targeting enterprise accounts. Make sure these systems integrate so you can track the full customer journey.

To give you a clearer picture of how these strategies play out in the real world, let’s examine some go-to-market strategy examples from successful tech companies.

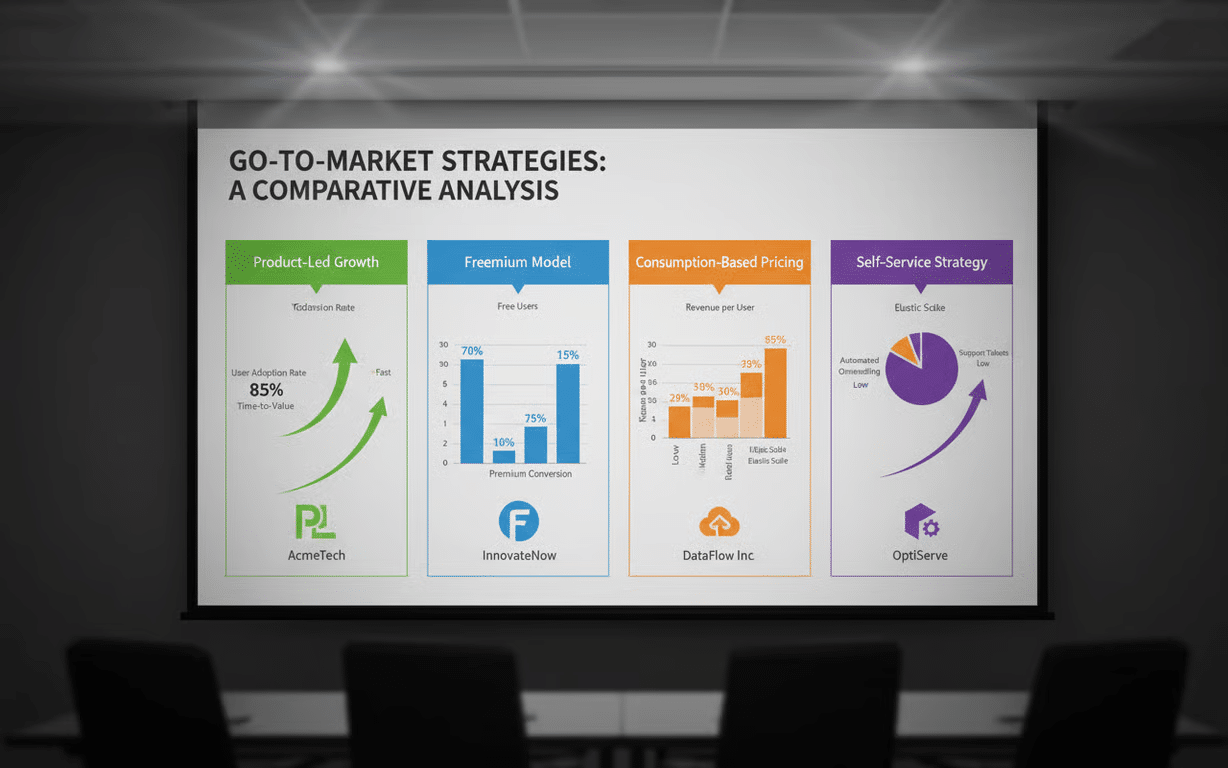

Go-to-market strategy examples from successful tech companies

Let me walk you through specific examples that demonstrate different approaches to market entry and growth.

Real-world go-to-market strategy examples

- Slack’s viral product-led approach: Slack entered a crowded collaboration market by making their product inherently viral. Every message sent to someone outside the workspace became an invitation to join. They focused on team adoption rather than top-down enterprise sales initially, letting satisfied users become advocates who pulled Slack into larger organizations. Their strategy prioritized user experience and organic growth over traditional marketing spend, resulting in one of the fastest-growing B2B applications ever.

- Zoom’s freemium conversion model: Zoom offered unlimited one-on-one meetings for free, removing all barriers to trying the product. They knew that once people experienced the superior video quality and ease of use, they’d upgrade for group meetings and advanced features. This strategy worked because the product delivered immediate value and the upgrade path was clear when users hit the 40-minute limit on group calls.

- Snowflake’s consumption-based pricing: Snowflake disrupted the data warehouse market with a strategy built around consumption pricing rather than upfront licensing. This reduced the initial commitment required from prospects and aligned costs with actual usage. Their approach made it easier for data teams to get started without lengthy procurement processes, accelerating adoption and creating a more predictable revenue model as usage grew.

- Atlassian’s self-service model: Atlassian built a billion-dollar business without a traditional sales team by creating products that developers could discover, evaluate, and purchase on their own. They invested heavily in product documentation, community forums, and transparent pricing. This bottom-up approach worked because their target users (developers and IT teams) preferred self-service over talking to salespeople.

Now that you’ve seen some successful examples, let’s discuss the tools and metrics you’ll need to measure your own GTM success and ensure you’re on the right track.

Tools and metrics for measuring GTM success

You can’t optimize what you don’t measure. Here are the essential tools and metrics I track for every tech client.

Essential GTM measurement tools and metrics

Core analytics platforms

- Google Analytics 4: Tracks website behavior and conversion paths

- Mixpanel or Amplitude: Provides product analytics for SaaS companies, showing how users engage with your application

- Revenue intelligence tools: Help you understand which marketing channels drive the most engaged users, not just the most traffic

Revenue metrics to monitor

- Customer acquisition cost (CAC) by channel: Understand where you’re getting the best ROI

- CAC payback period: How long it takes to recover the cost of acquiring a customer

- Sales cycle length: Identify bottlenecks in your process

- Win rate by source: Determine which lead sources convert best

- Pipeline velocity: Understand how quickly deals move through your funnel

Marketing performance indicators

- MQL to SQL conversion rates: Ensure marketing is generating quality leads

- Cost per MQL by channel: Track efficiency of different marketing channels

- Content engagement metrics: Time on page and scroll depth for key assets

- Email performance: Open rates and click-through rates to gauge message resonance

Customer success metrics

- Net revenue retention (NRR): Measure expansion revenue from existing customers

- Customer health scores: Using tools like Gainsight or ChurnZero

- Time to value: How quickly new customers achieve their first success milestone

- Customer lifetime value (LTV): Understand the long-term value of your acquisition efforts

Use Looker, Tableau, or Databox to create executive dashboards that show real-time performance. Set up automated reports that track week-over-week and month-over-month trends. Create custom alerts for when key metrics fall outside acceptable ranges so you can respond quickly to issues.

Before we wrap up, let’s cover some common GTM mistakes that tech companies make, so you can steer clear of these pitfalls and maximize your chances of success.

Common GTM mistakes tech companies make and how to avoid them

I’ve seen these mistakes derail otherwise promising tech companies. Here’s how to avoid them.

Common go-to-market mistakes and how to avoid them

- Targeting too broad an audience: Many tech companies try to be everything to everyone, diluting their message and wasting resources on unqualified prospects. Instead, start with a narrow ICP and dominate that segment before expanding. It’s better to own 50% of a small market than 2% of a large one.

- Launching before validating product-market fit: Don’t scale your marketing before you’ve proven that customers will pay for and use your product. Run a pilot program with 10-20 customers first. Achieve strong retention and gather case studies before you invest heavily in demand generation.

- Misaligning sales and marketing: When sales and marketing operate in silos, you get finger-pointing instead of revenue. Implement a service level agreement (SLA) that defines what constitutes a qualified lead and how quickly sales will follow up. Hold joint planning sessions and share the same revenue goals.

- Ignoring the competition: Some founders believe their product is so innovative that competition doesn’t matter. Your prospects are comparing you to alternatives, and you need to understand the competitive landscape. Create a battle card for each major competitor and train your team on how to position against them.

- Underinvesting in customer success: Acquiring customers is expensive. Losing them because of poor onboarding or support is inexcusable. Build a structured onboarding program that gets customers to their first value milestone quickly. Monitor usage data and intervene proactively when you see signs of disengagement.

To further clarify any lingering questions, here’s a comprehensive FAQ section addressing the most common inquiries about GTM strategy for tech companies.

Frequently Asked Questions

- What’s the difference between a go-to-market strategy and a marketing plan? A marketing plan focuses specifically on marketing tactics and campaigns, while a go-to-market strategy is more comprehensive. Your strategy encompasses marketing, sales, customer success, pricing, and distribution. It’s the complete plan for how you’ll acquire and serve customers. Think of the marketing plan as one component of your broader strategy.

- How long does it take to build an effective go-to-market strategy? For most B2B tech companies, plan on 4-6 weeks to develop a comprehensive strategy. This includes time for customer research, competitive analysis, messaging development, and internal alignment. Don’t rush this process. A well-researched strategy saves months of wasted execution on the wrong approach.

- Should I hire a go-to-market consultant or build the strategy in-house? If you have experienced marketing and sales leadership in-house, you can build the strategy internally. If your founding team is primarily technical, bringing in a go-to-market consultant or fractional CMO can accelerate the process and help you avoid costly mistakes. The investment typically pays for itself by preventing wasted marketing spend.

- How do I know if my go-to-market strategy is working? Look at leading indicators like pipeline generation, conversion rates at each stage, and sales cycle length. If you’re generating qualified pipeline, converting at healthy rates (10-20% from MQL to customer for B2B SaaS), and closing deals within your target timeframe, your strategy is working. If not, dig into the data to identify where prospects are dropping off.

- Can I use the same go-to-market strategy for different products? Only if the products target the same buyer persona and solve similar problems. If you’re launching a product for a different audience or use case, you need a distinct strategy. You can leverage the same channels and infrastructure. Just adapt the messaging and positioning for each product.

- What’s the biggest mistake tech companies make with their go-to-market strategy? The biggest mistake is scaling marketing and sales before achieving product-market fit. Companies burn through cash trying to generate demand for a product that doesn’t yet deliver consistent value. Validate that customers will pay for, use, and renew your product before you invest heavily in growth.

- How often should I update my go-to-market strategy? Review your strategy quarterly and make adjustments based on performance data and market feedback. Do a comprehensive refresh annually or when you’re entering a new market segment, launching a major product update, or seeing significant competitive changes. Your tactics should evolve continuously, but your core strategy should remain stable.

- What role does pricing play in go-to-market strategy? Pricing is a critical component that affects every other element of your strategy. Your pricing model determines your target customer segment, sales approach, and marketing channels. Value-based pricing typically works best for B2B tech, price based on the outcomes you deliver rather than your costs. Test different pricing models with early customers before you scale.

- How do I align my product roadmap with my go-to-market strategy? Your product and go-to-market teams should meet monthly to ensure alignment. Product development should prioritize features that address the needs of your ICP and support your positioning. Your strategy should account for planned product capabilities and avoid promising features that aren’t on the roadmap. Use a shared framework like jobs-to-be-done to ensure both teams understand customer needs.

- What metrics matter most for a B2B SaaS go-to-market strategy? Focus on customer acquisition cost (CAC), CAC payback period, win rate, average contract value, net revenue retention, and pipeline coverage (the ratio of pipeline to quota). These metrics tell you whether you’re acquiring customers efficiently, closing deals effectively, and retaining and expanding revenue. Track these in a dashboard that your entire leadership team reviews weekly.

Putting Your GTM Strategy into Action

Building a successful go-to-market strategy for your tech company requires a blend of strategic planning, data-driven decision-making, and a willingness to adapt. Start by clearly defining your ideal customer profile and mapping their journey. Then, craft a compelling value proposition and select the right channels to reach them. Finally, establish clear metrics and continuously monitor your performance, making adjustments as needed. As a next step, schedule a workshop with your team to begin outlining your ICP and buyer journey. This will provide a solid foundation for building a GTM strategy that drives sustainable growth.